Klover is an app that allows you to receive a cash advance as an alternative to a payday loan. Are you in need of short-term financial assistance but dread the high interest rates and hidden fees of traditional payday loans?

Look no further, as Klover, a popular cash advance app, offers a solution for those seeking quick funds without the costly pitfalls of traditional payday loans.

In this comprehensive analysis, we’ll explore Klover’s unique offerings, user experience, and evaluate if it’s the right choice for your financial needs based on various Klover reviews.

Key Takeaways

- Klover offers a secure and cost-effective alternative to traditional payday loans, providing users with cash advances, budgeting tools, and rewards.

- The app’s design is praised for its intuitive navigation and access to financial tools that help manage finances efficiently.

- Users should consider potential risks before committing to the service in order to ensure it meets their unique financial needs.

Klover Details | |

|---|---|

Product Name | Klover |

Max Loan Amount | $200 |

Fees | $0-$16.78 |

Promotions | None |

Introduction to Klover and Its Unique Offerings

Klover is a cash advance app that provides users with short-term financial assistance, budgeting tools, and cash back rewards. It has become a popular choice for those requiring quick funds without hidden fees or high interest rates.

Unlike payday loans, Klover cash advance offers a more cost-effective option, as it doesn’t charge interest or additional hidden fees. With klover cash advances, users can experience a better alternative to traditional payday loans.

The Klover app distinguishes itself from other cash advance apps by offering a variety of features that cater to the needs of users. With a nominal monthly fee of $3.99, Klover provides cash back rewards and prioritizes security with 256-bit encryption and Plaid to link to your bank account.

This combination of accessibility, affordability, and security makes Klover an attractive choice for those facing unexpected financial burdens.

What Does It Offer?

Klover provides users with access to free cash advances. But you also have a chance to win daily cash. Here's a closer look at what Klover offers.

Cash Advances

Klover's main product is the cash advances it offer to its users. Depending on your situation, you can access advances of up to $200. The cash advances come without any interest, late fees, or credit checks. Cash advances must be repaid on your next payday. Think of it like getting part of your paycheck a few days early.

Earn Points

In addition to the cash advance feature, you can earn points through the Klover app. Points are awarded for completing tasks like watching ads and taking surveys.

As you gain points, you can unlock a larger cash advance. You’ll also have the option to spend these points on daily sweepstakes entries. Each day, Klover users have the chance to win $100 through the sweepstakes, or one of five $20 prizes.

Data Usage

As mentioned, Klover offers a fee-free experience for most cash advances. The catch is that you must agree to give Klover access to your data. Your data may be used for anonymous market research or you might receive targeted advertisements based on the data you provide.

Navigating the Klover App - Design and User Experience

Crafted by designer and creative professional Aaron Davis, the Klover app boasts a user-friendly interface and intuitive navigation for a seamless user experience. Customers have commended the app for its streamlined process, responsiveness, and ease of use.

The app’s design not only ensures a pleasant user experience but also facilitates access to various financial tools and features that help users manage their finances effectively. With Klover’s user-centric design, users can easily track their cash advances, monitor their spending, and access valuable financial resources.

Klover's Financial Tools and Their Utility

Klover’s financial tools include budget planning, cash back rewards, and the Klover Plus membership (more on this below). The app’s budgeting tools enable users to effectively manage income and expenses, set financial goals, and earn bonus points.

These tools not only help users keep track of their finances but also provide valuable insights into their spending habits. Also, Klover’s integrated rewards program sets it apart from many cash advance apps.

Customers can earn points and acquire rewards for every dollar they spend with the Klover Visa® Card, which can be utilized for discounts on future acquisitions from chosen retailers or for donation possibilities with various charities around the globe.

Evaluating Klover's Cash Advance Service

Klover’s cash advance service enables users to access up to $200 without the need for a credit check, making it a convenient option for those in need of quick funds.

This instant cash advance service stands out due to its lack of credit checks, interest charges, and fees for an advance, offering users a more accessible and cost-effective solution compared to payday loans.

While Klover’s cash advance service can be beneficial for those in need of short-term financial assistance, users should carefully consider the potential risks associated with the decision to borrow money.

For instance, using borrowed money to bridge income gaps could result in a cycle of borrowing, leading to late payments or defaulting on other debt, such as credit card debt or even resorting to a payday loan.

Before committing to the app, users need to consider the advantages and disadvantages of using Klover’s cash advance service.

The convenience of instant cash advances and the absence of credit checks make Klover an attractive option, but users should remain mindful of the potential risks and make informed decisions about utilizing the service.

The Efficiency of Klover's Budgeting Tools

Klover’s budgeting tools help users:

- Manage their income and expenses

- Set financial goals

- Earn bonus points

- Monitor their spending

- Establish spending limits

- Make more informed financial decisions

Klover’s budgeting tools offer the following benefits:

- Users can set and track their financial goals

- The app helps maintain focus towards achieving these goals

- Bonus points earned through the app can be a motivating factor for users to stay committed to their financial objectives and improve their overall financial habits.

Are There Any Fees?

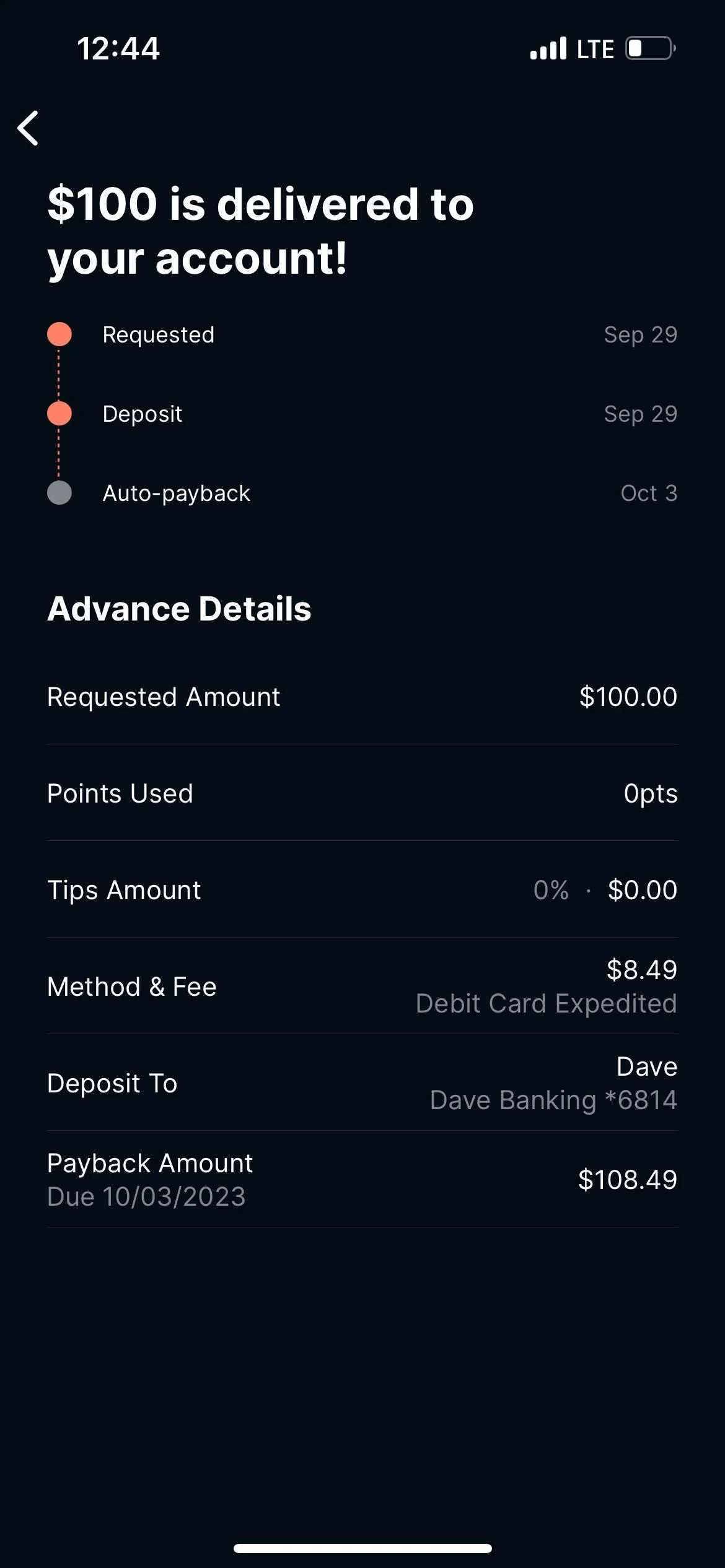

If you need a cash advance, you can get one for free. However, the standard option takes up to three business days to hit your account. Klover offers an instant option, which comes at a price of $1.99 to $16.78.

Klover+ is an additional service that provides the following features for a monthly fee of $3.99:

- Credit monitoring through Experian

- Ability to track spending habits

- Price comparisons for products

- Access to financial advisors

- Triple points when scanning receipts

Klover+ offers users an enhanced experience, with valuable features that can help improve their financial habits and achieve their financial goals.

How Does Klover Compare?

Klover isn’t the only cash advance option out there. Before you sign up with Klover, I recommend that you check out the following alternatives.

Empower is an app that offers cash advances of up to $250. The slightly higher cash advance doesn’t come with any interest charges or late fees. However, you’ll face a $8 monthly fee after a 14-day free trial.

Earnin is another option that provides cash advances of up to $500. The app is free to use. But you’ll have the option to leave a tip, which funds the app’s operations. The funds you take out will be repaid immediately after your paycheck hits your account.

Header |  | ||

|---|---|---|---|

Rating | |||

Monthly Fee | $0 | $8 monthly | $0 |

Max. Loan Amount | $200 | $250 | $750 |

Banking? | No | Yes | No |

Cell |

How Do I Open An Account?

Klover advertises that the signup process only takes a few seconds. You can get started by entering your name, email address, and phone number. Get started here >>

You’ll also need to link your bank account in order to get access to an advance. The process of linking your bank account will likely take more than a few seconds. But if you meet the conditions, it shouldn't take very long. To qualify for Klover cash advances, you must meet the following requirements:

- Must have at least three direct deposits sent to the checking account

- Have at least 3 consistent direct deposits in the last 60 days

- No pay gaps

- Paychecks must come from the same employer, with matching paycheck descriptions

- You must be paid on weekly or bi-weekly schedule

- Your checking account must be in good standing

Is It Safe And Secure?

Klover takes your privacy seriously, using bank-level, military-grade security to protect your information, including 256-bit encryption. If you decide to cancel Klover, you’ll have the option to delete your data at any time by contacting the customer support team.

How Do I Contact Klover?

Klover provides customer support through the following channels:

- Ticket system on their help website, where users can raise inquiries and get help

- Phone call during specific business hours

- Email during specific business hours

Klover customer support is available around the clock, Monday through Friday. If you have a question, reach out to support@joinklover.com.

You’ll also have the option to chat with support staff from 10 AM to 5 PM on Monday through Friday. Finally, you can call 888-293-8767 on weekdays from 10 AM to 3 PM. All times listed are in CST.

Despite the presence of multiple channels for customer support, some users have encountered challenges in contacting a representative or getting prompt help from the customer support team.

This feedback highlights the importance of continuous improvement in customer service responsiveness and effectiveness to ensure a positive user experience and maintain trust in the Klover platform.

Klover App - Is It Worth Your Time and Money?

Although Klover’s cash advance and budgeting tools can prove helpful for those seeking short-term financial assistance, it’s important for users to contemplate potential risks and carefully evaluate the pros and cons before using the app.

The convenience of instant cash advances, the absence of credit checks, and access to valuable financial tools make Klover an attractive option for many.

Yet, users need to be aware of potential risks tied to using Klover’s cash advance service, like making late payments or defaulting on other debts. It’s essential for users to make informed decisions about utilizing the service and to assess if Klover’s offerings align with their financial goals and circumstances.

Klover’s A+ rating from the Better Business Bureau reflects its dedication to deliver a dependable and trustworthy service. Regardless, users need to determine if Klover aligns with their unique financial needs and make responsible choices about using the app’s cash advance service.

Summary

In conclusion, Klover is a cash advance app that offers users short-term financial assistance, budgeting tools, and cash back rewards, making it a popular choice for those in need of quick funds without the costly pitfalls of traditional payday loans.

With its user-friendly interface, easy navigation, and valuable financial tools, Klover can be a helpful resource for those looking to improve their financial habits and achieve their goals.

However, users should carefully consider the potential risks associated with using Klover’s cash advance service and weigh the pros and cons before committing to the app.

By making informed decisions and using Klover responsibly, users can leverage the app’s features to better manage their finances and achieve their financial objectives.

Klover Features

Cash Advance Limits | Up to $200 |

Monthly Fees | $0 |

Interest Charges | None |

Banking | None |

Fee for Expedited Cash Advance | $1.99 - $16.78 |

Customer Service Number | 1-888-293-8767 |

Customer Service Email | support@joinklover.com |

Customer Service Hours (Phone) | Monday-Friday, 10 AM - 3 PM CST |

Rewards Program | Yes |

Promotions | None |

Frequently Asked Questions

How quickly can I get money from Klover?

Klover offers cash advances but you may have to wait up to three business days to receive the money. Alternatively, an express fee can be paid for cash in under 24 hours.

How much will Klover give you?

Klover will give you a cash advance up to $200 with no interest, late fees, credit checks, or interest charges. You can access this cash even if your payday is two weeks away.

Does Klover affect your credit score?

Klover does not check or build your credit score, so using it will not affect your existing credit score in any way.

What is the maximum cash advance amount offered by Klover?

Klover offers cash advances up to $200, depending on individual eligibility.

How do I increase my cash advance limit on Klover?

Klover Review

-

Fees and Charges

-

Ease of Use

-

Products and Services

-

Customer Service

-

Tools and Resources

Overall

Summary

Klover is a fintech company that offers free cash advances up to $200 in exchange for permission to use your data.

Pros

- Quick setup

- No interest charges

- No Monthly fees

- No credit check

Cons

- Advances limited to $200

- Fee required to expedite transaction

Sarah Sharkey is a personal finance writer covering banking, insurance, credit cards, mortgages and student loans. She has written for numerous finance publications, including MagnifyMoney, Business Insider and ChooseFI. Her blog, Adventurous Adulting, helps young adults get a handle on their finances.

Editor: Colin Graves Reviewed by: Chris Muller