When you’re living paycheck to paycheck, cash flow issues are frustrating. You know the funds are coming with your next paycheck and you’re eagerly anticipating it more than you’d like. Whether it’s a timing issue or unexpected emergencies you had to cover, a cash advance app like B9 could be an option for you.

With late fees and overdraft fees, missing a payment can get expensive. With the B9 cash advance app, you could improve your cash flow issues for the month. Let’s take a closer look to see if this is the right fit for your situation.

Quick Summary

- The B9 cash advance app is a membership-based advance service.

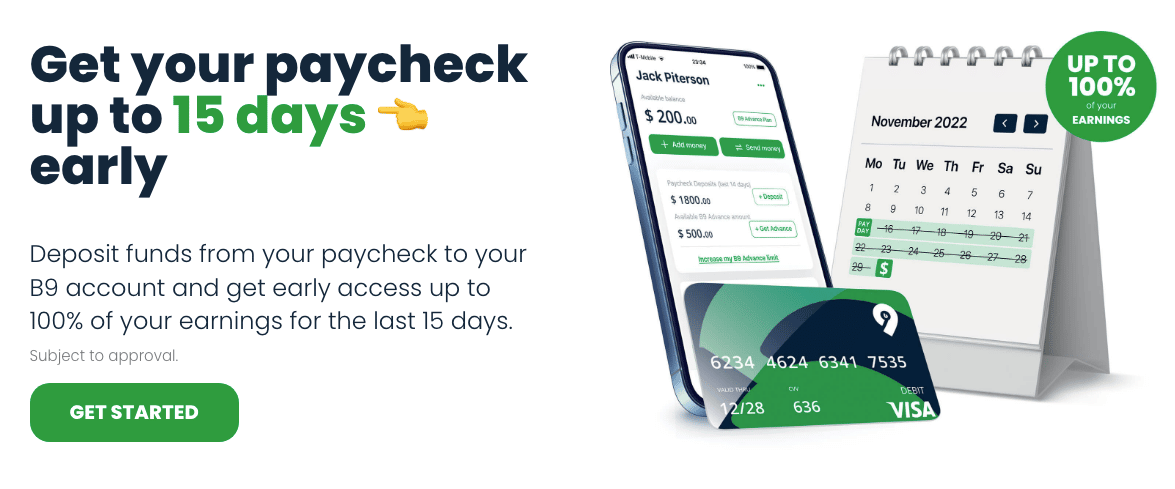

- You can get an advance on your paycheck up to 15 days early.

- However, you’ll pay a monthly fee to access your funds in advance.

B9 Details | |

|---|---|

Product Name | B9 Cash Advance App |

Min Deposit | None |

Monthly Fee | $9.99/mo to $19.99/mo |

Savings Reward | Up to 4% Cash Back |

Promotions | None |

What Is B9 Cash Advance App?

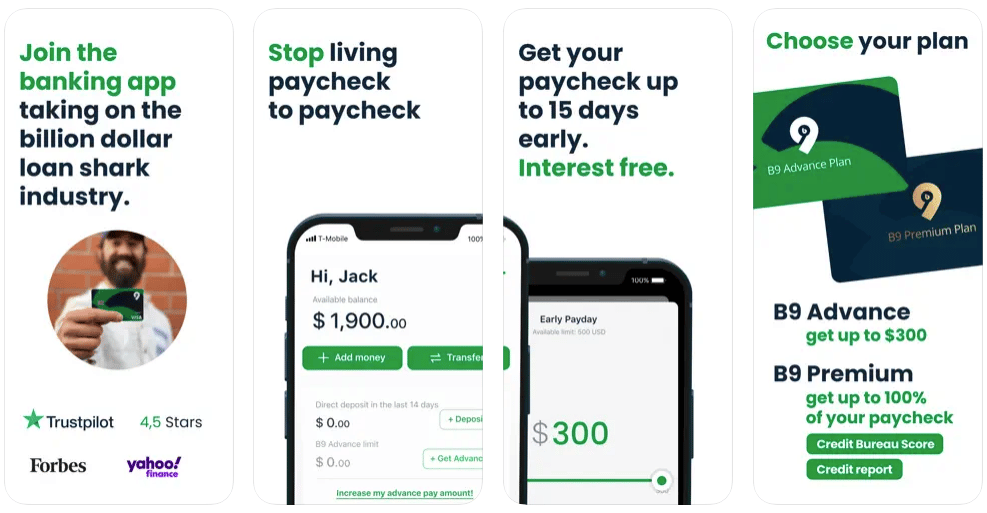

The B9 cash advance app offers a membership-based advance service. The app is available on Android and iOS devices. But there is no desktop version of the platform.

As a part of the platform, you must open a B9 checking account, which comes with a debit card. But it’s important to note that B9 isn’t a bank. Instead, the banking services are provided by Evolve Bank & Trust, which carries FDIC insurance.

What Does It Offer?

B9 isn’t the only way to get your hands on the funds you need. But it does set itself apart from the crowd with the following features. Here’s what stands out.

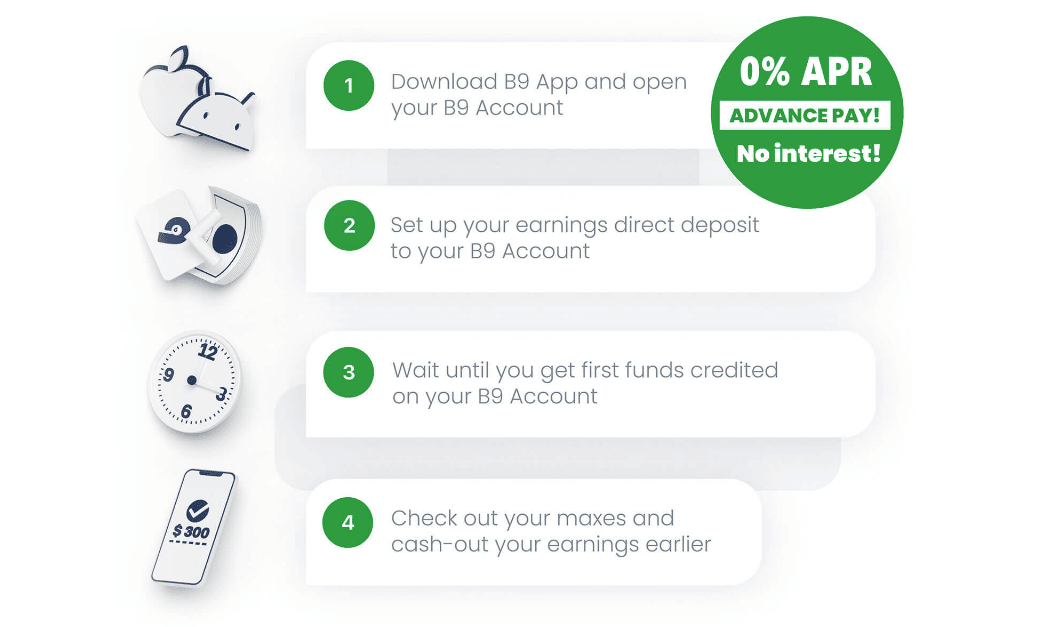

Must Connect Your Direct Deposit

Before you can ask for a cash advance, you need to set up your earnings direct deposit into your new checking account. After you receive your first paycheck in your B9 account, you can cash out your earnings as needed up to your limit.

While using this checking account, you won’t encounter any overdraft fees or need to maintain a minimum balance. Additionally, the checking account allows you to transfer cash between B9 members instantly.

Up To 4% Cash Back

Cash back is always a worthwhile opportunity. When you work with B9, the debit card comes with cash back opportunities. You can earn cash back in several categories, including fast food, paying at restaurants, and pumping gas.

When you spend $300 to $500 in a category, you’ll receive 1% cash back directly in your account the following month. When you spend over $500 in any category, you’ll receive 2% cash back in your checking account the following month. At the end of the year, you’ll receive a bonus that doubles your cash back earned throughout the year. So, you have an opportunity to earn up to 4% cash back!

The College Investor's Top Picks for the Best Cash Advance Apps

Want to see how B9 compare to others out there? Read our review.

Get Your Paycheck Up To 15 Days Early

B9 has two membership tiers. If you are a Premium Member, you can get early access to your entire paycheck up to 15 days early. However, the monthly fee is $19.99 to access this option.

If you opt for the Advance Plan, you’ll have access to advances of up to $300.

Are There Any Fees?

To access the cash advance options, it’s a $9.99 monthly subscription fee. If you want to access up to 100% of your paycheck and your credit report, you’ll need the Premium Plan at $19.99 per month.

But the good news is that the cash advances don’t come with interest payments so you can enjoy a 0% APR.

How Do I Contact B9 Cash Advance App?

B9 offers customer service options in both Spanish and English which is a helpful feature. The customer service agents are available within the app Monday through Friday from 5 a.m. to 9 p.m. PST and Saturday and Sunday from 6 a.m. to 6 p.m. EST.

If you have a complaint, send it to compliance@mbanq.com.

The company also seems to have a very happy customer base. The app has earned 4.3 out of 5 stars in the Apple App Store, 4.1 out of 5 stars in the Google Play Store, and 4.3 out of 5 stars on Trustpilot.

How Does B9 Cash Advance App Compare?

B9 is the only cash advance app that gives you the chance to access up to 100% of your paycheck early. Even though the option is only available for Premium Members, it’s impressive for anyone that needs early access to their paycheck.

But there are other cash advance apps out there.

Two of the best options include Earnin, which offers $100 cash advances at first. Earnin is free to use, and it accepts tips to keep its service running.

8 Earnin Alternatives

In this article, we compare other companies that offer more than cash advance features. Or check out the video below.

Another option is Brigit, which offers cash advances between $25 and $250. Like B9, there is a $9.99 subscription plan. But there is also a free option.

Each of these cash advance options can help you regulate cash flow issues.

Header |  |  | |

|---|---|---|---|

Rating | |||

Cash Advance Limits | 100% Access to Paycheck | $500 | $250 |

Fees | $9.99-$19.99/mo | $0 | $9.99/mo |

Banking? | |||

Cell | Cell |

How Do I Open An Account?

Opening a B9 account starts by downloading the iOS or Android app. You need a monthly salary of at least $500 to qualify.

Be prepared to provide the following details:

- Direct deposit information

- Your Social Security Number or Individual Tax Identification Number

- Residential mailing address

- Government-issued ID

Is It Safe And Secure?

The funds held in your B9 account are FDIC insured for up to $250,000. This is possible because Evolve Bank & Trust provides the banking services for B9.

Beyond FDIC insurance, extensive PCI-DSS encryption keeps your data secure.

Is It Worth It?

B9 offers very early access to your paycheck. If you are facing cash flow issues, this can come in handy. But before you jump in, weigh your potential savings against the monthly subscription. If you only occasionally need a cash advance, then it can make sense to seek out another opportunity.

For those using cash advances on a more regular basis, the monthly fee might be worth it. But it’s a good idea to consider why you regularly need cash advances. It might be time to look at the bigger issues by mapping out a budget to stay on track or boosting your income through a side hustle.

B9 Features

Cash Advance Limits | 100% Of your paycheck |

Cashback Rewards | Up to 4% |

Early Direct Deposit | Up to 15 days early |

Monthly Fees | B9 Advance is $9.99 B9 Premium is $19.99 |

Instant Transfers | $0 |

Cash Back | 4% With B9 Visa Debit Card |

Branches | None |

ATM Limits |

|

Transfer Limits |

|

Customer Service | Available within the app |

Customer Service Email | compliance@mbanq.com |

Customer Service Hours | Mon. through Fri. from 5 a.m. to 9 p.m. PST Sat. and Sun. from 6 a.m. to 6 p.m. EST |

Mobile App Availability | |

FDIC Certificate | |

Promotions | None |

B9 Cash Advance App

-

Cost

-

Ease of Use

-

Features and Options

-

Commissions and Fees

-

Customer Service

Overall

Summary

If you find yourself eagerly anticipating your next paycheck more than you’d like, a cash advance app like B9 could be a great option. Read the review to find out if this is the right fit for your situation.

Pros

- Premium members can get a cash advance of up to 100% of their paycheck

- No cash advance rush fees

- Get funds up to 15 days before your paycheck

- Cash back opportunities with B9 debit card

Cons

- Monthly membership fees are between $9.99 to $19.99

- Limited features

- Must open a B9 checking account

Sarah Sharkey is a personal finance writer covering banking, insurance, credit cards, mortgages and student loans. She has written for numerous finance publications, including MagnifyMoney, Business Insider and ChooseFI. Her blog, Adventurous Adulting, helps young adults get a handle on their finances.

Editor: Claire Tak