Organizing your financial and digital life can be a pain. And that pain can be amplified when you want to share your digital life with a partner or a trusted advisor.

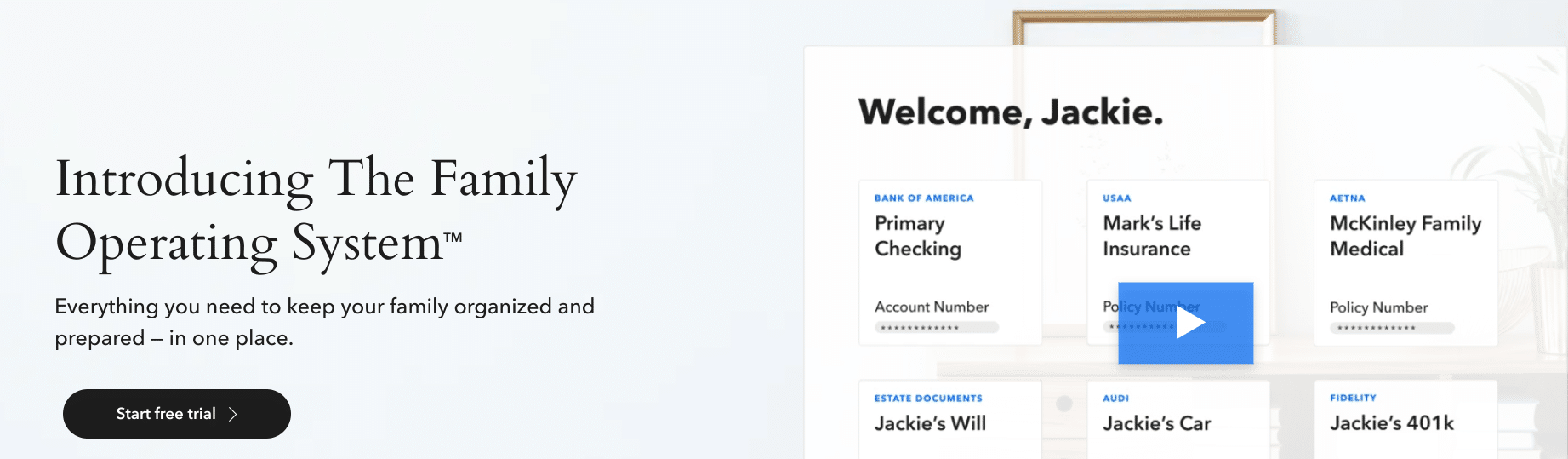

Trustworthy is an app and website working to solve that pain point. It serves as a family operating hub where account holders can manage their financial life and share with collaborators while keeping their information safe and secure.

Trustworthy is a beautiful and easy-to-use technological solution to our increasingly complex digital and financial lives. However, it comes with a high price tag. This review explains why the app works so well and explores alternatives for those who deem the price tag too high.

Trustworthy Details | |

|---|---|

Product Name | Trustworthy Company |

Features | Secure Document Storage, Financial Planning Reminders, Collaboration Tools, Concierge Service |

Cost | $120 to $480 Per Year |

Platform | Web and iOS |

Promotions | 14-Day Free Trial |

What Is Trustworthy?

Trustworthy is a document storage service that is specifically designed to help users organize their financial life. Users can upload estate planning documents, Social Security cards, birth certificates, insurance documents, and other critical financial information. They can also connect directly to their insurance and financial accounts.

Trustworthy uses guided workflows and concierge services (personalized help) to ensure that new users don’t miss uploading critical information. It also has some impressive AI designed to keep users on top of their financial life. It reminds users to review financial information annually, to check beneficiaries, and to pay for insurance.

When a user requests information (such as where to get a will done), Trustworthy sends updates to make sure it happens. Plus, the platform offers encryption and multi-factor authentication along with multiple sharing settings.

What Does It Offer?

Trustworthy is a platform that makes it easy to organize financial and estate planning documents.

Web Interface And iOS App

Users who are just getting set up may want to use Trustworthy’s web interface. On desktop, anyone can quickly connect accounts and upload insurance policies.

Customers who use iOS (Apple) products can also connect to their accounts using a phone or mobile device. This makes it easy to snap pictures and upload them to Trustworthy. Unfortunately, there isn't currently a mobile app for Android device owners.

Innovative Security Measures

Trustworthy uses all standard security measures including encryption and requires multi-factor authentication to keep information safe. But it also has innovative security features.

Trustworthy redacts certain information in the UI. And it only displays it when a user clicks on it specifically. It also uses Aliasing to remove all critical information off of Trustworthy’s servers. With Aliasing, Trustworthy mitigates the potentially devastating effects of a cyber breach.

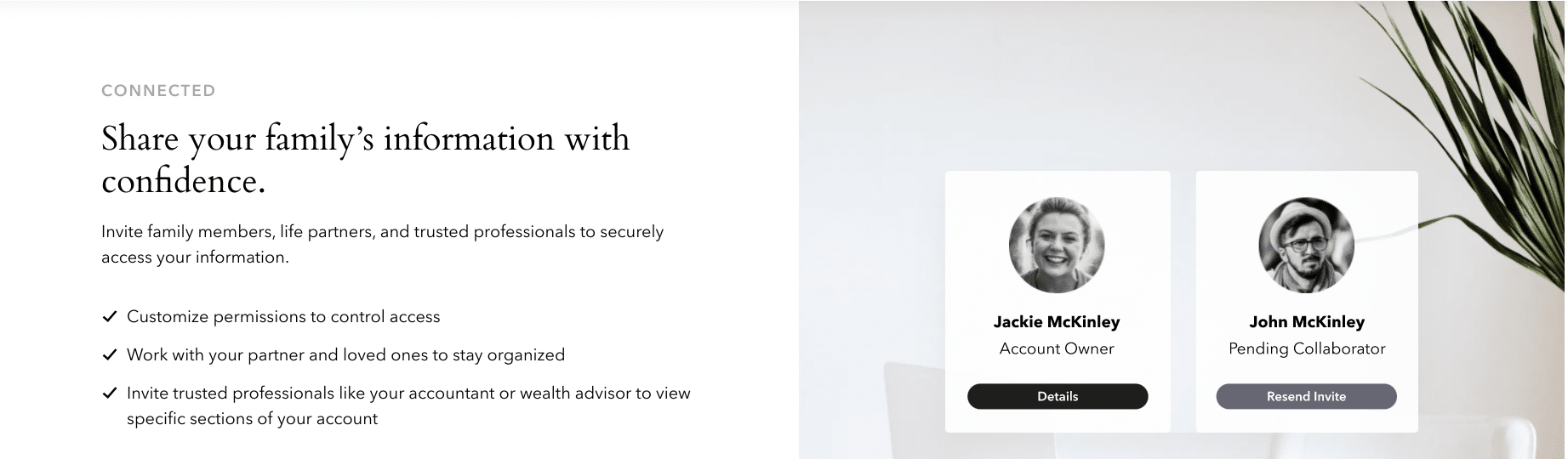

Customizable Collaboration Levels

The Trustworthy app allows users to set up various collaboration permissions. A user may set up full sharing (for example, the information you may share with a spouse), partial sharing (for example to share financial documents with a financial advisor), and even driven sharing (giving full access in the event of your death).

Trustworthy allows users to set up emergency contacts who will be contacted if they fail to respond to prompts over an extended time. These contacts will “inherit” your information.

Concierge Estate Planning Services

Trustworthy won’t create your will or estate planning documents. But it will help users get the information they need to make important financial decisions.

For example, users can ask for a list of lawyers who draw up wills or trusts in their area. Trustworthy’s concierge service is partially AI-driven. But it's also enabled by real humans researching on behalf of their users.

Anyone who has lost a critical document (such as a birth certificate or passport) knows how difficult it can be to get a new one. Trustworthy's concierge team makes this process a little bit easier. But it should be noted that Gold-level members get less access to dedicated concierge support than Platinum members.

A Central Hub For Family Information

Trustworthy has guided workflows for critical information. But users can also add important family information. For example, users can upload bicycle VINs, combinations for a vault in their homes, passphrases for crypto hardware, or other free form information.

AI-Driven Reminders

Trustworthy uses Natural Language Processing (a form of Artificial Intelligence) and a few custom algorithms to keep users on top of their financial life. It reminds users to renew insurance policies, review documents, and complete tasks associated with basic estate planning.

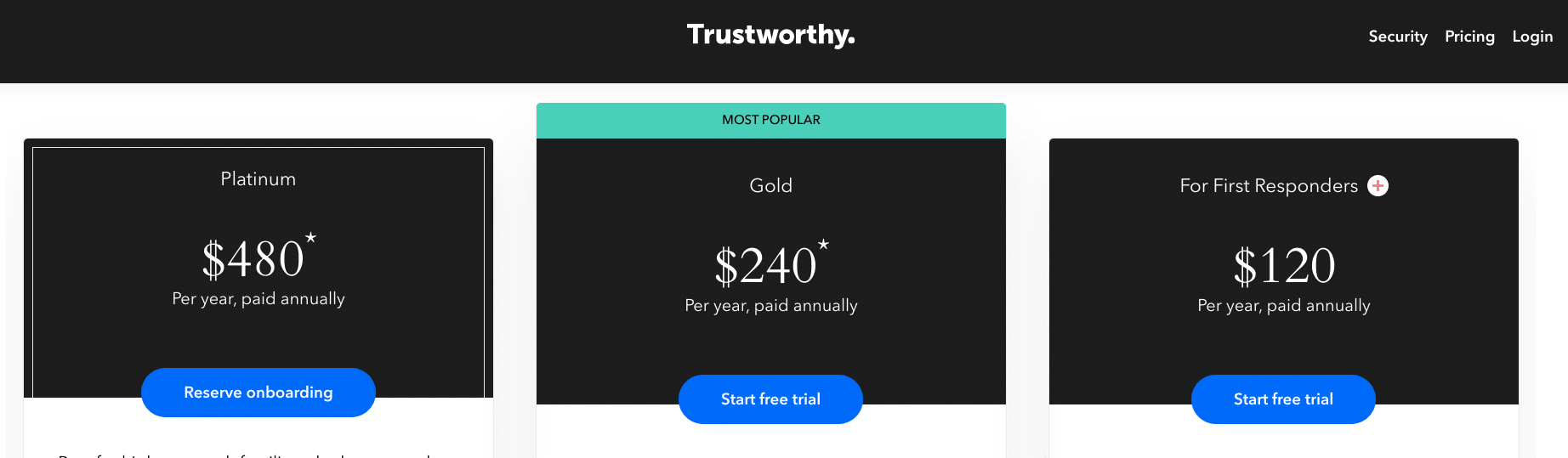

Are There Any Fees?

Trustworthy offers a free 14-day trial and has annual pricing after the trial ends. Its most expensive plan is $480 annually and includes a “white glove” concierge service including individualized attention as you get onboarded to the platform. It also includes 75 GB of secured storage.

The less expensive Gold plan offers similar features but limited support hours and only 30 GB of secured storage. This plan costs $240 per year. First responders can qualify for a discount and only pay $120 annually for the Gold plan.

How Do I Contact Trustworthy?

Trustworthy has a chatbot on its website that serves up answers to frequently asked questions or sends messages to the support team. You can find the chatbot in the bottom right-hand corner of most of the website pages.

To contact support directly you can email hello@trustworthy.com or call 1-888-254-0696.

The Trustworthy Headquarters is located at:

1390 Market Street #200

San Francisco, CA 94102

How Does Trustworthy Compare?

Trustworthy is an innovative financial planning app. It focuses on a people-centric design and solves a real problem associated with financial disorganization. Unlike most financial apps, Trustworthy can serve as a hub for your financial life. It’s not a budget tool or net worth tracking tool. It's a secure organization and collaboration tool. The tool is beautiful, easy to use, and solves a huge problem. But the price tag is high.

Only individuals with very complex financial lives require the sophistication of Trustworthy. Most could use a password vault like LastPass ($3 to $4 per month for plans that include document storage) or a printable document like the In Case of Emergency Binder ($39 PDF) to achieve the same result at a lower cost.

How Do I Open An Account?

Users can start an account by downloading the app from the app store or by creating a profile from the Trustworthy website. Trustworthy asks a few simple questions and then creates a secure account for the users. Users can create an account without providing a credit card to pay an annual fee. However, the account becomes inaccessible after 14 days unless the user pays the annual fee.

Is It Safe And Secure?

Trustworthy uses some of the best security practices including encryption and multi-factor authentication. It also uses a security practice called tokenizing or aliasing to keep your financial information safe. If a hacker were to breach Trustworthy’s servers, the hacker would not have direct access to any of your financial accounts.

Is It Worth It?

I see a lot of value in Trustworthy, especially in its collaboration settings. Individuals with complex financial situations who struggle with financial organization may find that the platform is worth the high annual price tag.

Typically, I recommend that readers should take advantage of a free trial to see if they like a product. However, onboarding with Trustworthy is a lot of work. And I don’t think the effort is worthwhile if your financial life is generally organized.

For now, only people with very complex financial lives should consider Trustworthy for their secure document and estate planning needs. Trustworthy offers impressive technology. But I expect to see competitors in the space that offer similar products for less than half the price.

Trustworthy Features

Features | Secure Document Storage, Financial Planning Reminders, Collaboration Tools, Concierge Service |

Cost |

|

Storage Limit |

|

Password Management | No |

Security | 256-bit encryption, two-factor authentication, aliasing |

Customer Service Number | 1-888-254-0696 |

Customer Service Email | hello@trustworthy.com |

Other Customer Service Options | 1-888-254-0696 |

Customer Service Hours | Chatbot |

Web/Desktop Access | Yes |

Mobile App Availability | iOS |

Promotions | 14-day free trial |

Trustworthy Review

-

Cost

-

Features and Tools

-

Ease of Use

-

Customer Service

Overall

Summary

Trustworthy is a cloud storage platform that helps families organize their financial documents and keep their vital information up to date.

Pros

- Easy to understand workflows

- Flexible collaboration settings

- Dynamic reminders about action items

- Excellent app security

Cons

- High cost ranging from $120-$480/yr

- Onboarding can be a lot of work (especially using the app)

- App is currently only available on iOS

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Clint Proctor Reviewed by: Claire Tak