Almost 75% of Americans make New Year's Resolutions, and the third most common resolution is finance-related. The second most-common also happens to be self-improvement, which honestly goes hand in hand with what we're talking about here.

Whether you're looking to get out of debt, save more money, achieve a money goal like a vacation or house purchase, or even build up enough go to hell money to leave your job, let's make this year your best financial year yet.

Unfortunately, most resolutions get broken too. However, this year is going to be different. This year you're going to keep the promise you make to yourself and you're going to improve your finances. Here are five tips to help you succeed in the next 12 months.

1. Get Organized

No matter your New Year's Resolution, you will NOT be successful unless you get organized. Some people call this budgeting, but this is the step even before budgeting. Seriously - just get organized.

What this means is taking an accurate inventory of everything:

- Income - what's coming in (each month)

- Expenses - what's going out (each money)

- What you own - asset and account balances

- What you owe - all your debts, balances, and minimum amount due each month

Want a tool to help? Check out this list of the best money and budgeting apps.

You also need to take an inventory of your time, using your calendar. This is where most people miss - do you know exactly where you're spending your time each day/week/month?

Finally, you need to spend a little time thinking about what you value. What are the most important things in your life? Is it spending time with your family? Volunteering? Working? Sports? Vacations? Figuring out what you value the most (and probably the top 3-5 things you value the most), along with things you don't value, goes a long way towards aligning your finances in a way that will work.

Then What?

Once you're organized, you can really start to make effective decisions that will help you achieve your New Year's resolution or other money goal. I'm not here to tell you what you should do, that's personal. But given you have everything laid out - your income, expenses, time, and values - you can start making decisions.

For example, if your goal is to pay off debt, well look at your income and expenses and see what the "delta" is (the difference between the two numbers), and use that extra to start paying down debt.

Don't have a delta? Well, then start looking line by line on both your income side and expense side. Can you earn more money (this may require looking at your calendar and time too)? Can you cut expenses (this may require you to look at what you value and see if you're wasting money on things you don't value)?

The fact is, money is personal. There's not right or wrong answer here - but the truth will align with a combo of income, expenses, time, and values. If you want bigger budgeting guide, check this out: Budgeting For Your Personality and Style.

2. Improve Your Credit

No matter your resolution, improving your credit will be a game-changer! Looking to save money? This helps. Looking for a new job? This helps! Looking to buy a house or rent an apartment? This helps!

This step actually takes several sub-steps to complete. First, you want to start cleaning up your credit. Order a credit report (you can do this for free at AnnualCreditReport.com). You may find some adverse information that is lowering your credit score. Next, fix the bad credit listed on your report.

For instance, dispute any negative information that isn't true such as late payments. If you want to repay creditors listed on your credit report, make sure the debts aren't considered zombie debts. Zombie debts are too old for creditors to sue you for or even contact you about because of the statute of limitations. If you contact the creditor about the debt you start the statute of limitations over again.

You can also check out our full guide at How To Improve Your Credit Score.

3. Build Your Stash

One of the most common financial goals after paying off debt is saving money. Whether you're building an emergency fund, saving for retirement, or saving for a goal like a house, building your stash of money is key.

Side Note: It doesn't have to be pay down debt OR save. You can try to do both at the same time. In fact, you probably should!

Savings Account: You want to open or use your savings account. The account is a way to save money. For instance, you can build an emergency fund using the account. You can choose to have a debit card or limit the access to it by not having one. Open an account here: Best High-Yield Savings Accounts.

IRA: An IRA (or Individual Retirement Account) is a great tool to save for retirement. There are some IRA income and contribution limits, but if you qualify, take advantage! Check out the best places to open an IRA here.

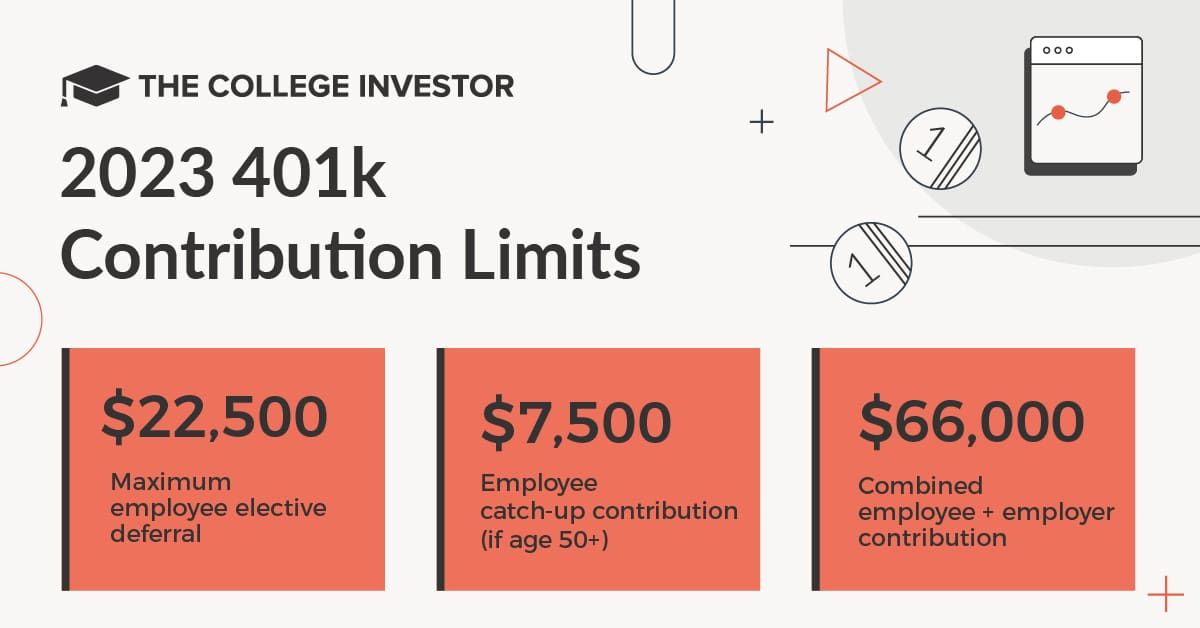

401k: If your employer offers a 401k, you definitely need to be taking advantage of it! In fact, many employers offer "matching contributions" - this is FREE money your employer is giving you to save for retirement. By not taking advantage of it, you're essentially taking a pay cut.

4. Pay Yourself First

You may think that this isn't the way to become debt-free (or achieve any other money goal) this year, but it is. It's easier to go into debt when you're constantly spending money. But this is a big mindset shift on how you allocate your money.

For instance, say you want to go to the movies or out to dinner with friends. You don't have the money, so you charge it to one of your credit cards. If you pay yourself first, you can have money to do the things you want to do. More importantly, you don't incur new debts. Go ahead and pay yourself.

After all, you're the one working hard to achieve your dreams. The easiest way to pay yourself is by having a separate savings account. If you have direct deposit, you can have a small amount transferred into that account.

5. Live Within Your Means (And Values)

We all want things that we can't have. For example, you may want that 65" flat-screen television. However, you can't afford it. The debt-free thing to do is to save up for it or not buy it. Living within your means requires making big changes - and aligning your spending to your values.

On a basic level, you can:

- Stop using savings or credit cards for items you really can't afford.

- Make a monthly budget based on your income.

- Track your spending.

- Pay bills on time.

But when it comes to making a trade-off, you need to go back to your value-set and see what really matters to you. You may feel like you need that 65" TV, but what if watching TV isn't something that you particularly do or enjoy? Maybe that money shouldn't be spent, or maybe it needs to go towards something else you actually value.

Bonus Tip: Search For Free Money

As a bonus reminder, I always like to encourage everyone to find the free money in their life. You'd be surprised how much free money is out there that you may be entitled to. I recently found $100 that was owed to me by Wells Fargo for an old account they closed (and never contacted me about).

Plus, there are a lot of offers and bonus incentives for things that you're already doing! Maybe you were going to open that checking or savings account this year? Did you know that banks offer you bonus offers just for being a customer? If you were going to sign up anyway, get paid for it!

In the meantime, check out this guide to finding free money.

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Clint Proctor Reviewed by: Claire Tak