I love this money quote: “The best time to plant a tree was 20 years ago, the second-best time is today”. It’s an old Chinese proverb and it relates exactly to my top financial hack – front-loading your life. I’m a big believer that you need to do as much as you possibly can as early as you possibly can. It’s so much better to load up on savings and investments in your 20s versus your 30s. But if you’re in your 30s already, it’s much better to start now than in your 50s or 60s.

That’s why I wanted to share some strategies and reasons for front-loading your life. Yes, it may be a small sacrifice up front, but it will pay dividends for years to come.

Why You Should Be Front Loading Your Life

Front loading is simple: stash as much money away as early as possible. It’s so much easier to max out your 401k when you’re younger, before you have large expenses, kids, and other things that add up. It’s also easier when you’re younger to make the small sacrifices you need to make more money and save more money.

The truth is, you need to be front loading – whether you’re in your 20s or later. Front loading helps you because:

- The Power of Compound Interest will maximize your savings and investments over time

- It gives you more freedom when you need it later in life

- You have the ability to front-load easier earlier in life

But if you don’t know where to start, here are some simple (and not so simple) suggestions.

Strategies to Front-Load Your Life

There are a couple of ways that you can really front-load your life for success – but it does involve some sacrifice. Here are some strategies that you should consider to front-load your life. Even if you’re already in your 30s or 40s, you can use these as food for thought for reducing expenses.

Minimizing Housing Costs

One of the biggest ways that you can front-load your life is to live at home while in college or after graduation. Since housing is typically your biggest expense, cutting back or eliminating that and, in turn, saving that money, can put you on the fast track to financial success.

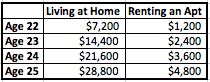

Let’s look at two scenarios: living at home rent-free, and living in a shared apartment, where your share of the rent is $500. Let’s say that, in both scenarios, you have an extra $100 you could save as well. So, if you live at home, you’re saving $600 per month, where living in an apartment only saves you $100 per month. Just look at what this can do for your savings in just 4 years:

Just living at home puts $24,000 more in your savings account in just 4 years! If you do nothing else, and invest that money at age 25 in the stock market, it will be worth $521,000 at age 65. If you only have $4,800, it will only be worth $104,000 at age 65. That’s the power of compound interest!

Prolong Large Purchases as Long as Possible

Another key to front loading your life is to prolong large purchases as long as possible. By this, I mean don’t buy that expensive car right out of college – keep driving the beater car you had in high school until it dies. If you really need a car, stick to an old used car that is inexpensive. Or better yet, avoid buying a car at all if possible – it’s a strategy that Mr. Money Mustache is all about.

But there are other large purchases that tend to plague recent grads as well: clothes, computers, watches, vacations. All of these things can wait. Imagine if you combined your savings with housing with the savings you could achieve by avoiding large purchases – think of how rich you will be!

Maximize as Much as You Can

Beyond saving and avoiding large purchases, you should also maximize investing accounts as much as you can. Try to max out your 401k at work, and make sure that you contribute the max to your IRA each year.

While you’re young is also the best time to start a side hustle, and leverage that extra income to boost your savings. It can be much, much harder to maintain a money-making side hustle once you have a family! Leverage your youth!

Final Thoughts

Final Thoughts

The goal isn’t to be frugal forever. In fact, the goal should be to front load as quickly as possible so that you can be less and less frugal as life goes on. The few early choices you have can make a huge difference later in life.

If you can save and do a few smart things early on, you can live the life you want forever.

What other tips and tactics do you have to front load your life? Are you a believer in this strategy?

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Clint Proctor Reviewed by: Chris Muller