The end of the year can be a whirlwind. But the actions you take over these final months can have large impacts on your tax bill next April and your long-term financial health.

By taking proactive steps now, you can ensure that your financial life is organized and primed for success as you head into the new year.

Wondering which items are most important to add to your end of year financial to-do list? Below are nine money moves to make before the new year to boost your bottom line.

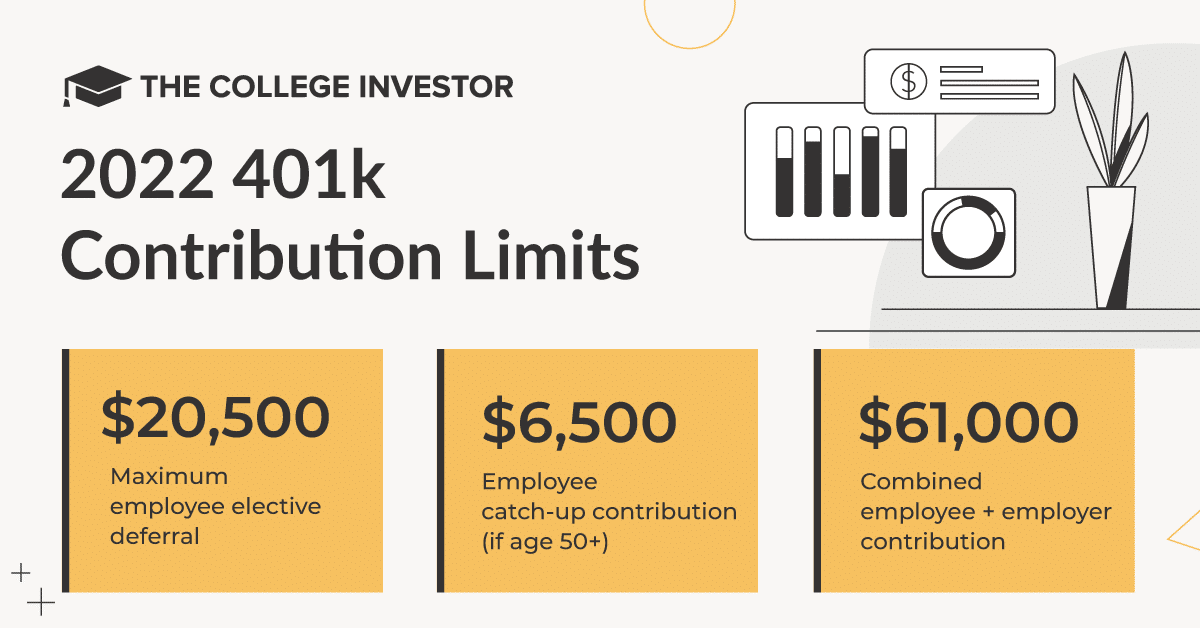

1. Adjust Payroll Contributions To Your 401(k)

Most 401(k) plans require employees to complete their retirement contributions by December 31st. This year, you can contribute up to $20,500 (plus an additional $6,500 in catch-up contributions for those over age 50).

If you can handle a small reduction to your paycheck, consider boosting the contribution to your 401(k) plan. Even a 1-2% increase in contributions can yield long-term benefits.

Some companies issue year-end bonuses. If you’re slated to receive one, consider earmarking a portion for your 401(k). This can help you boost your savings rate without dipping into your regular cash flow.

2. Review Account Beneficiaries

As long as you’re logging into your 401(k) account, check the beneficiary on the account. This is especially important if you got married or divorced in the last year. But it's an important task for everyone to include on their end of year financial to-do list.

A few years ago, I went through my accounts to check beneficiaries. During the process, I realized that my mom was still listed as the beneficiary on one small account, even though I’ve been married for a decade.

3. Spend It If You’ve Got It!

Over the past year, many companies have instituted well-being accounts or allowances to help employees cover some work-from-home costs. These accounts may expire at the end of the year, so spend that money if it’s available to you. Additionally, be sure to request reimbursement promptly to ensure you receive this benefit.

On top of these new accounts, many employees have access to Flexible Spending Accounts.

Flexible Spending Accounts (FSAs) are accounts that do not roll over from year to year. Employers can offer Health FSAs, Adoption FSAs, Dependent Care FSAs, Typically, employees who have an FSA will need to spend money by the end of the calendar year. Additionally, they will need to request reimbursement shortly after the year ends.

If you have access to any of these accounts, spend the money this year, and submit receipts as soon as possible, so you can receive reimbursement. Remember, this advice only applies to Flex Spending Accounts. Health Savings Accounts allow you to save year after year.

4. Enroll In A Health Plan

Most people need to enroll in a health plan at some point between October and November of this year. If your employer offers health insurance, review the options. If possible, review options with your spouse to see which employer offers the best insurance at the lowest prices. Don’t forget to enroll your children as well.

Open Enrollment for Healthcare.gov starts November 1st and runs through December 15th. This is the ideal time to enroll in a health insurance plan if you need to buy one through the exchange. Many people who don’t have health insurance through work can qualify for subsidized health insurance when they buy through the exchanges.

5. Review Your Credit Report

Each year, you’re entitled to a free credit report from each of the three major credit bureaus. That makes it a great assignment to include on your year-end financial to-do list.

Credit reports show every inquiry and every outstanding debt. Reviewing a report is particularly important if you have delinquent debts that have been sold to other creditors.

You can easily download your report from AnnualCreditReport.com or use a free service like CreditKarma.com to get your free report and insights that can help you understand the report.

Related: Best Credit Monitoring Services

6. Plan Charitable Giving

The 2022 deduction limits for gifts to charities, including donor-advised funds, is 30% of adjusted gross income (AGI) for contributions of non-cash assets, if the assets were held more than one year, and 60% of AGI for contributions of cash.

People with larger charitable giving goals may benefit from more advanced planning. Some givers choose to give every few years so that they can itemize their tax deductions. Meeting with a CPA by the end of the year can help givers decide on the best timing for their giving.

7. Start Tracking Business Expenses

It’s not quite tax-time, but you can get a jump on business taxes by starting to track your business expenses, and categorizing past expenses. Finding an app like Keeper Tax, Everlance or Hurdlr can help you track and categorize your business expenses. All of these apps have downloadable reports that make tax filing easier.

8. Make An Estimated Tax Payment

If you’re self-employed (or a side hustler), you're likely to owe tax money to the IRS. To avoid a big tax bill, you may want to make a quarterly estimated tax payment. Even a single payment can help relieve some of the financial burdens that come with paying a year’s worth of taxes in April.

This advice comes from my first side-hustle experience as a working adult. In my first year hustling, I earned over $10,000 from various gigs. I paid no estimated taxes and I didn’t adjust my withholdings at my W-2 job.

The result was a $2,500 tax bill which took a month and a half of hustling to cover. Don’t be like me. Make at least one estimated payment before figuring out your full tax burden for the year.

9. Execute Backdoor Roth Conversions

A high-income earner may not qualify for a traditional Roth IRA contribution. But the backdoor Roth is a tax loophole that allows high-income earners to get money into a Roth account. Once the money is inside the account, it's protected against future taxation.

In general, it's easiest to execute a backdoor Roth conversion when the calendar year matches the tax year. So add this task to your end of year financial to-do list and try to complete it before December 31st.

Have Extra Time? Use It To Level Up Your Finances

If you have a few quiet days to reflect and plan at the end of the year, there are some exercises that may help. First, check your numbers. A few of the key numbers to understand are your credit score, the total amount of debt you owe, your net worth, your income, and your spending. You may also want to share these numbers with your partner to normalize conversations about money.

Second, set one financial goal. It's easy to get swept up in the fresh start of a new year and overwhelm ourselves with goals for a dozen good intentions. But instead of a burdensome load of goals, try starting with one financial goal for the year ahead. It will help you stay focused. And if you accomplish it early in the year, you can always set a new goal to work towards!

Finally, plan expenses for next year. If you hate specific monthly budgeting methods, try a new one. Also, try to map major expenses that may come up in the next one to three years. Writing down these expenses along with the expected price tags can help you set up savings plans to cover these costs without debt.

Hannah is a wife, mom, and described personal finance geek. She excels with spreadsheets (and puns)! She regularly explores in-depth financial topics and enjoys looking at the latest tools and trends with money.

Editor: Clint Proctor