Embrace is a pet insurance company that offers a wide range of pet insurance options to give pet owners peace of mind for their pets. Here’s what you need to know about Embrace Pet Insurance to decide if it's the right pet insurance provider for you.

Buying pet insurance policy can be a great way to protect the furry members of your family while also protecting your wallet.

But while there are several pet insurance companies available today, they're not all created equal. Some providers only have one-size-fits-all plans that offer little to no flexibility.

Are you looking for pet health insurance that gives you options in choosing your deductible, your wellness coverage, reimbursement amount, annual coverage limits, and more? If so, you might want to consider Embrace Pet Insurance.

Embrace Pet Insurance Details | |

|---|---|

Product Name | Embrace Pet Insurance |

Annual Coverage Limits | $5,000 To Unlimited |

Reimbursement Rate | 70% to 90% |

Deductible | $100, $250, $500, $750 or $1000 |

Promotions | 10% Multi-Pet Discount |

Who Is Embrace Pet Insurance?

Embrace Pet Insurance is a pet health insurance company that offers a comprehensive product designed to cover dog or cat accidents and illnesses.

It operates a bit like human health insurance. When a pet is sick or suffers from an accident, a pet owner can take the pet to any veterinarian. The pet owner pays as they normally would, but submits a claim through Embrace’s online portal or through the app. Embrace then reimburses pet owners for a percentage of the covered costs.

Pet owners will be responsible for paying monthly premiums, covering the cost of an annual deductible, and paying for a portion of the veterinary bills. But Embrace can take over the rest of the costs when a claim is submitted for covered conditions.

What Does It Cover?

Embrace Pet Insurance covers all pets up to age 14 at the time of enrollment. When insuring your pet for the first time, on or after their 15th birthday, Embrace offers accident-only coverage to cover unexpected accidents that may trip up your older pets. Under their accident and illness plan, it covers most major health problems including:

- Diagnostics

- Prescriptions

- Behavioral Issues

- Prosthetics and mobility devices.

- Surgery and specialized care

- Cancers and growths

- Hip dysplasia

- Swallowed objects

- Dental or gum diseases up to $1,000 per year

- Cancer

- Diabetes

- Urinary Tract Infections

- Exam fees for emergency consultations

- Knee surgery for ACL repairs

- And quite a bit more.

Embrace also offers an optional “wellness plan” which allows pet owners to set money aside for preventative care activities such as vaccines, annual visits, grooming, tick or flea medication, and other ongoing pet ownership costs. Embrace reimburses pet owners for wellness claims submitted. And by participating in the wellness plan, you get a $25 discount on the cost of your wellness plan.

Related: Can You Actually Afford A Pet?

What Doesn't It Cover?

There are a few costs that Embrace Pet Insurance doesn’t cover. Most routine vet care isn’t covered by an Embrace insurance plan (unless you buy the wellness plan with it). Additionally, breeding or pregnancy costs and cosmetic procedures aren't eligible for coverage. A few other edge cases (such as Avian flu or Nuclear war) aren’t covered by Embrace, but they are few and far between.

The real concern for most pet owners will be how Embrace defines pre-existing conditions, which it doesn’t cover. Any condition that is discovered before the end of a 14-day waiting period is considered a pre-existing condition, even if your pet has never received treatment related to it. And the waiting period could actually be 6 months for orthopedic conditions in dogs without the completion of their orthopedic waiver.

This can include problems associated with a dog’s behavior. For example, a dog that eats rocks couldn’t have a rock removal surgery until it stops eating rocks for at least 12 months. And pre-existing conditions that have been defined as having a "temporary exclusion" can only become eligible for coverage again after 12 months of being symptom-free.

Will I Have A Deductible?

With Embrace, you can choose a deductible of $100, $250, $500, $750 or $1,000 per year. The higher your deductible, the lower your premium costs, all other factors being equal.

What Is The Reimbursement Percentage?

In 2023, Embrace has more deductible and reimbursement options on their online quote engine for their accident and illness plan. Embrace now offers an unlimited reimbursement option (previously, their highest reimbursement option was a $30K, annual max).

As the pet owner, you are responsible for sharing costs beyond the deductible. Embrace allows policy holders to select reimbursement percentages ranging from 70% to 90%.

That means Embrace will reimburse policyholders up to 90% of covered costs after the deductible is met, up to an annual maximum. Choosing a higher reimbursement percentage means that you’ll pay higher premiums each month.

Are There Coverage Limits?

Embrace Pet Insurance offers annual limits ranging from $5,000 to unlimited in most states. Keep in mind that choosing a higher annual coverage limit will increase the cost of your monthly premium. They don't include lifetime payout limits on any of their plans.

Supplemental Coverage Offers More Flexibility And Savings

Design a plan that’s best for you. They now offer the option to include or exclude both pet Rx and exam fee coverage on each policy. This means you get the exact coverage you want at a price you feel good about.

How Does Embrace Pet Insurance Compare?

We love that Embrace's annual payout limits can be as high as unlimited in the majority of states. They also offer a wide variety of deductible options and each of those deductibles can diminish over time if you have reimbursement-free years.

But if your dog is 15 years or older, you'll only be able to get accident coverage through Embrace. And even if your dog is younger that limit, you'll probably still want to get quotes from a few additional pet insurers just to make sure that you're getting the best rate. Here's a quick look at how Embrace compares:

Header |  |  |  |

|---|---|---|---|

Rating | |||

Coverage Limits | $5,000 to Unlimited | Cats: $7,000 to $15,000 Dogs: $10,000 to $20,000 | $5,000 to $100,000 |

Reimbursement Rate | 70% to 90% | 90% | 70% to 90% |

Deductibles | $100 to $1,000 | $100 to $500 | $100 to $500 |

Diminishing Deductible | |||

Age Limit (For Illness Coverage) | 14 Years Old | None | Varies By Breed |

Cell |

How Do I Get A Quote?

It's easy to check rates with Embrace. To get started, simply visit their website and click the big "Get Your Quote" button.

Next, you'll type in your pet's breed and age as well as your own email address and zip code. From there, you'll be able to choose your annual payout limit, deductible, and whether or not you want to add wellness coverage. Once you've made your selections, you'll see your estimated monthly premiums.

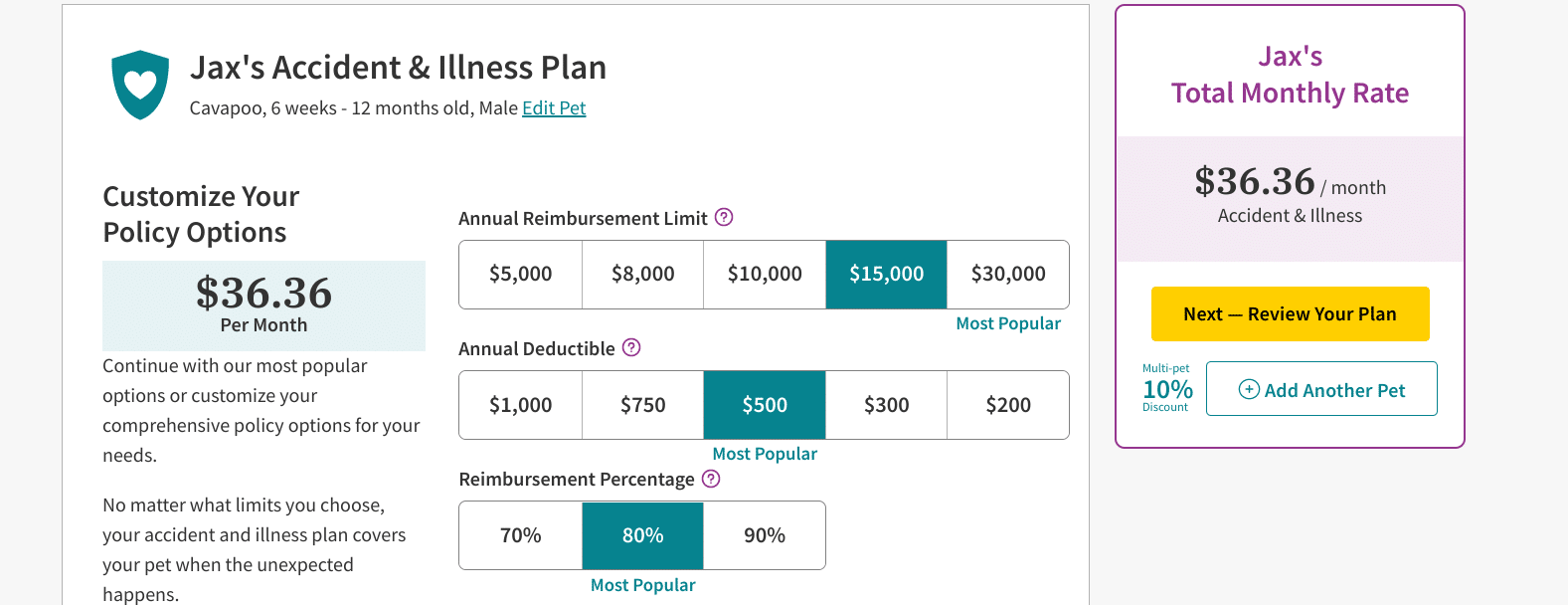

We ran a test quote on "Jax," a male Cavapoo puppy (6 weeks to 12 months old) with a $15,000 annual coverage limit, $500 deductible, and an 80% reimbursement rate. For the test, we did not add any Wellness Rewards. The monthly premiums we were shown for a plan with those specifics was $36.36 per month.

If you like the prices you see after using Embrace's quote tool, you can provide your payment information to purchase the policy immediately. However, in order for coverage to officially begin, you'll need to provide your pet's vet records to Embrace during the 14-day waiting period.

How Do I Contact Embrace?

Embrace operates two distinct customer service channels. The first is its main contact center which primarily onboards new customers and answers their questions. If you don't have an existing policy with Embrace yet, this is the team you'll contact.

The main Embrace Pet Insurance contact center phone number is 800-511-9172. Representatives are available Monday through Friday, 8 AM to 8 PM (ET) and Saturday from 10 AM to 2 PM (ET).

Once you have a live policy with Embrace, you'll get access to 24/7 telehealth services from PawSupport Pet Pros. Pet Pros can help with evaluating a pet's medical condition and healthcare needs. Customers can communicate with a Pet Pro by phone, chat, or video.

Is It Worth It?

Embrace Pet Insurance offers pet owners a lot of flexibility with its wide range of deductibles, unlimited reimbursements, reimbursement percentages, and annual maximums. The wellness plan also makes it easy to budget in irregular pet ownership costs like heartworm medicine, poop tests, and vaccines.

The one drawback to Embrace is how it treats pre-existing conditions. Pet owners who have pets who struggle with behavioral issues or who have previous medical conditions may not find the right kind of coverage through Embrace.

As with all types of insurance, be sure to shop around by comparing Embrace's pricing and plans with other pet insurance companies. A few top pet insurance providers worth checking out include Pumpkin, PetFirst, Healthy Paws, and Nationwide.

Embrace Pet Insurance FAQs

Here are the answers to some of the most common questions that people ask about Embrace:

Is Embrace Pet Insurance legit?

Yes, Embrace is a legitimate pet insurance company that has a strong track record of paying out on claims. In 2019, 93% of its customers' claims were covered.

Is Embrace Pet Insurance accepted everywhere?

Yes and no. Embrace uses a reimbursement insurance model. This means you'll need to pay your vet out of your pocket and then file a claim for reimbursement. But it also means that you don't have to worry about vet networks. All eligible conditions will be covered in accordance with your policy limits regardless of the veterinarian that you choose.

As of Jan. 1, 2023, Embrace Pet Insurance ceased writing new policies in the state of Maine. This is because the state of Maine made changes to their underwriting requirements that are not in alignment with the company's current product.

How fast does Embrace Pet Insurance reimburse?

It generally takes 10-15 business days for claims to process. Once your claim has been processed and approved, it could take up to an additional 10 business days to receive paper check reimbursements while direct deposit payouts should arrive within three business days.

Do Embrace Pet Insurance policies cover diagnostic exams?

Yes, diagnostic exam fees are covered at no extra cost.

DISCLOSURE

Pet health insurance is administered by Embrace Pet Insurance Agency, LLC and underwritten by one of the licensed insurers of American Modern Insurance Group, Inc., including American Modern Home Insurance Company d/b/a in CA as American Modern Insurance Company (Lic. No 2222-8), and American Southern Home Insurance Company. Coverage is subject to policy terms, conditions, limitations, exclusions, underwriting review, and approval, and may not be available for all risks or in all states. Rates and discounts vary, are determined by many factors, and are subject to change. Wellness Rewards is offered as a supplementary, non-insurance benefit administered by Embrace Pet Insurance Agency in the United States. © 2020 American Modern Insurance Group, Inc. + Wellness Rewards not available in Rhode Island.

Embrace Pet Insurance Features

Annual Coverage Limits | $5,000 to unlimited (in most states) |

Reimbursement Rate | 70-90% (Unlimited reimbursements) |

Deductible Options |

|

Preventative Care Coverage |

Required adding a "wellness plan" to your policy |

Healthcare Coverage | Covered:

Not covered:

Visit Embrace's website to view a full list of covered conditions. |

Multi-Pet Discount | Yes, 10% off for two or more pets |

Upper Age Limits | Yes, accident-only coverage for pets over 14 years of age |

Breed Restrictions | None |

Waiting Period |

|

Customer Service Number | 1-800-779-1539 |

Customer Service Hours | 8 AM-8 PM, Mon-Fri (EST) 10 AM-2 pm, Sat (EST) |

Customer Service Email | askclaims@embracepetinsurance.com |

Mobile App Availability | iOS and Android |

Promotions | 10% multi-pet discount for policies with two or more pets |

Embrace Pet Insurance Review

-

Premiums

-

Deductibles

-

Reimbursement Rate

-

Annual Limits

-

Coverage Benefits

Overall

Summary

Embrace Pet Insurance is a company that offers a comprehensive insurance product designed to cover illnesses or accidents for dogs and cats.

Pros

- Multiple deductible options

- Up to 90% reimbursement of covered costs

- No breed restrictions

- Optional wellness plan covers vaccines, annual visits, and more

Cons

- Accident-only coverage for pets over age 14.

- No unlimited annual coverage plans offered

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Clint Proctor Reviewed by: Chris Muller