Ron Popeil, founder of Ronco and the inventor of the Showtime Rotisserie famously taught his customers to, “Set it and forget it” and at least 8 million people loved him for it. Popeil harnessed the power of automation way before it was the cool thing to do.

Recently, behavioral economists have jumped onto the “set it and forget it” train. The result? Recommendations to automate bill paying, automate saving, automated investing and more. By and large, automation will help you improve your finances, “but wait there’s more.”

Automation has a dark underbelly. Service companies, financial companies (and increasingly product based companies) rely on automation to charge their customers for unneeded services, and to sneak in ridiculous charges.

If you were to scan all your credit card and debit card statements, you would probably find at least one subscription you aren’t using. You might also find a couple of late fees or financial fees that you’ve long since forgotten. When you’ve automated bad habits, it’s tough to break them. To break my own bad habits, I started using a software called Trim.

Trim Details | |

|---|---|

Product Name | Trim |

Services | Cancel Subscriptions |

Cost | $99/year |

Supported Services | Cable, Internet, Phone, Subscriptions |

Promotions | 14 Day Free Trial |

What Is Trim?

Trim is a financial app that can help you save money. It can do this by negotiating lowers bills, helping you find and cancel unused subscriptions, and more.

Trim was founded in 2015, and was acquired by OneMain Financial in 2021. It has recently been rebranded as OneMain Trim - but most people still simply call it Trim.

Trim Helps Stop Recurring Charges

Trim bills itself as a virtual assistant that saves you money.

Its core competency is cancelling subscriptions that you aren’t using. Trim uses an algorithm to identify recurring charges, and it communicates with users via Text or Facebook Messenger.

To identify recurring charges, Trim has to look at your bank accounts. That means that you have to connect your accounts to the app. Trim uses an encryption service called Plaid to keep your data safe.

Plaid makes sure that Trim does not have access to your login information, and they have read only access to your accounts. Trim uses encryption for their website and database, and it requires 2 factor authentication for users. Your information is as safe as it would be at any banking institution.

After Trim identifies recurring charges, Trim will text (or Facebook Message) you to ask you if you want to cancel them.

If you reply, “Cancel ________.” Trim will do the cancellation for you. Trim doesn’t charge a fee for this service.

Unfortunately, the service isn’t perfect. I asked Trim to cancel an identity theft protection service I no longer wanted. It wasn’t able to, so I made the call myself. At least Trim brought the subscription to my attention.

On the whole, Trim seems to have great success cancelling gym memberships, box subscriptions, media subscriptions, and notoriously difficult cable TV contracts

How Trim Works To Save You Money

Trim's founders noticed that many online chats used the same texts and scripts to get results. So, they created a bot that allows Trim to communicate with customer service reps over chat - and it's probably a forceful customer to be reckoned with because there is no emotion involved.

Trim asks and negotiates with your companies to save you money! Try it for yourself by downloading Trim here.

Trim reports a 70% success rate in lowering customer's bills.

Trim Success Story

Tana Williams from Debt Free Forties was able to save $240 on her Spectrum Internet bill in about 5 minutes using Trim.

While tightening down on her budget, she thought she had cut her Internet cost as much as possible by asking for any discounts that Spectrum had available. Since she works at home, she needed to keep a decent Internet speed. Spectrum was kind enough to provide a discount for the following year, but it only worked out to about $6 a month.

After researching additional ways to cut her budget, she figured she'd give Trim a try. It's free, and they only get paid if they're able to save you something. Since she was already on StraightTalk for her phones and had a discount through Spectrum on her Internet, she figured it was a long shot.

She was surprised when she received a text and email confirming an additional savings for $20 a month on her Internet. No changing plans or speeds - just a discount thanks to Trim negotiating on her behalf with Spectrum. She spent 5 minutes adding her account information to the Trim website, and Trim did the heavy lifting by saving her $240 a year!

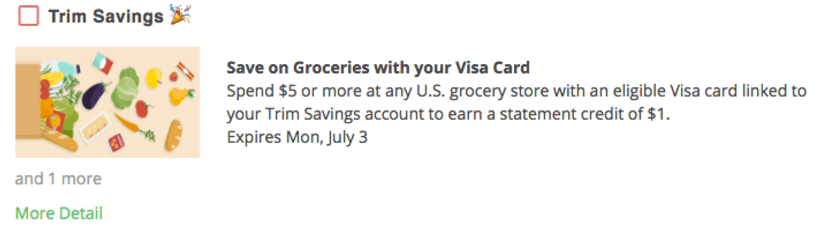

Earn Cash Back

Trim has worked out a fascinating relationship with Visa. Every month, they offer 3-4 ways to earn a dollar or two in cash back. This month, spending more than $5 at the grocery store and $5 at a restaurant yielded a dollar cash back each. I was skeptical about this, but it’s legit.

You can find out about the monthly offers by looking at the messages that Trim sends you through Facebook Messenger. You can opt out of these at any time.

This is a little less secure than the subscription cancellation service. To qualify for “Trim Savings” you have to enter your Visa card into Trim’s database. They won’t use your Visa information for any reason outside of Trim Savings.

However, Trim shares offers via Facebook Messenger. That means Facebook knows that you’re using Trim. Is that a big deal? It wasn’t for me, but you need to be the judge of that.

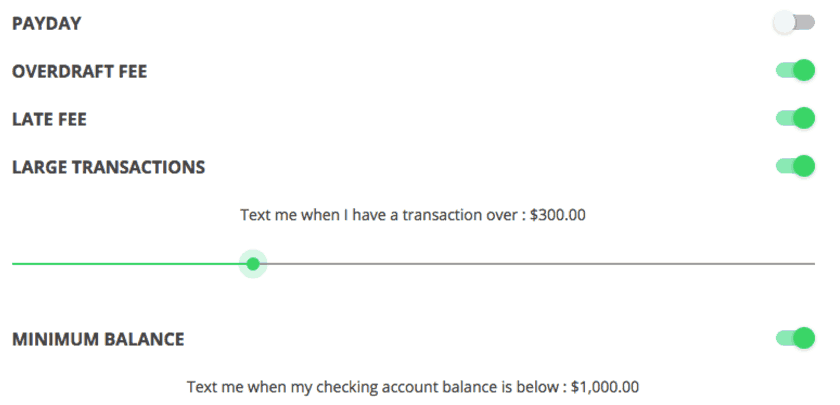

Set Up Alerts

You can also use Trim to set up text message alerts. You can prompt a low balance alert (for example when your checking account falls below $1000), a late fee alert, and others.

These are great for getting you to pay attention to your finances when you’re falling behind. I set up a number of alerts that will help me keep my finances on track.

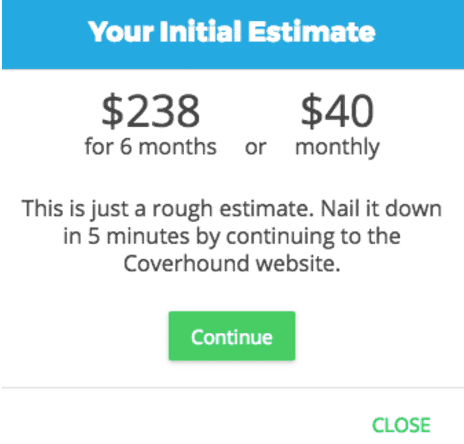

Lower Your Bills

Trim also offers a few ways to save money on common bills. For example, Trim has a partnership with an Auto Insurance Broker that can help you save money. I’m the queen of deal shopping insurance, so I was shocked to see that the rate Trim quoted matched my current auto insurance rate. I’ll check back in six months to see if they beat it.

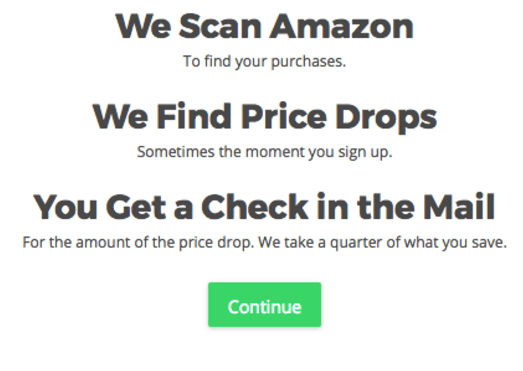

Another cool way that Trim saves money is by watching prices on Amazon. Amazon used to have a 7-day price guarantee. If the price of an item you purchased dropped within 7 days of your purchase, you could ask Amazon for a price adjustment.

Amazon no longer guarantees that you’ll get a price adjustment, but that doesn’t stop Trim from asking. If Trim manages to secure Amazon savings for you, they’ll send you a check for 75% of the savings. You get to keep the remaining 25%.

I signed up for the service because it never hurts to try, but I don’t want to waste my own energy on negotiating price adjustments with Amazon.

Finally, Trim has a pilot program where they are trying to lower bills by negotiating with Comcast. On average, they’ve saved their customers $10 per month on cable and internet services. I’m not a Comcast customer, so I didn’t enroll in this program.

I’m Trimming. Will you?

Trim is an amazing tool if you’re looking to keep bad habits out of your financial automation. It was easy to setup, and it is easy to save money and earn a little cash back. I think that most people will benefit from Trim, even if they opt out of the cash back savings and bill lowering options. Check it out, save some cash, and enjoy a fuller bank account.

What do you think about Trim? Do you have some bad automation habits that Trim might be able to help you with?

Ask Trim Review

-

Commission & Fees

-

Customer Service

-

Ease Of Use

Overall

Summary

Ask Trim is a free service that helps you save money by cutting unused subscriptions & earning cash back. Learn more in this Ask Trim review.

Pros

- Save money cutting unused subscriptions

- Trim scans and handles everything automatically

Cons

- There is an annual subscription to use the service

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Clint Proctor Reviewed by: Chris Muller