You know that you should cut back on your electricity use. Energy waste costs money that you don’t have, you’re generating carbon emissions, your energy company might cause nasty pollution. Despite all the environmental guilt piled on by every teacher, NPR podcast and PBS broadcast since the dawn of the nineties, we all waste energy.

But what if you could reduce electrical waste, save money on your bills, earn beer money or help pay down your student loan in the process? Would you do it? A company called OhmConnect is making that a reality in California. We explain how OhmConnect works and how you can cash in.

Buying Credits To Balance A Load

Energy companies don’t like using less efficient power plants because they aren’t cost effective, and they make it harder for the company to comply with pollution regulations. Because of that, California’s energy companies are actually willing to pay consumers not to use energy during peak energy demand.

Of course, energy companies can’t make contracts with every individual household to buy back energy. That's where OhmConnect comes into the picture. OhmConnect is a clean tech company that helps its users save energy and make money. In fact, their company won the U.S. Department of Energy’s American Energy Data Challenge.

Their algorithms monitor energy use on a minute by minute basis. When energy use approaches peak loads (where the less efficient power plants come online), they start taking action.

Here’s How Their Actions Work

OhmHour Basics

The key to making money from OhmConnect comes from understanding the OhmHour.

OhmConnect wants their user base to reduce energy consumption during unexpectedly high load periods. They call those periods “OhmHours.”

When an OhmHour goes into effect, you want to cut back energy use as far as possible from your baseline energy use. That means turning off your TV, shutting off lights, killing the washer and dryer etc. Hardcore OhmConnect users typically leave the house during OhmHours because they want to reduce energy as much as possible.

How does OhmConnect determine whether or not you saved energy? They calculate your home’s average energy consumption on 10 weekdays or 4 weekend days prior to OhmHour. Your average consumption is your baseline. If you reduce energy consumption below your baseline, you earn points. Each point is worth one cent.

How Much Can I Earn from OhmConnect?

How lucrative a side hustle OhmConnect is depends on a variety of factors, mainly including:

- 1How much energy you use on a regular basis (your baseline)

- 2how much you’re willing to conserve during the #OhmHour.

Some customers earn a bit of extra pocket change while others have paid their entire annual energy bill (or more!) just for conserving during these key moments.

But the bottom line is, if you’re a California resident who gets their utilities from PG&E, SCE, and SDG&E, you can earn money from it. Below we’ve outlined ways to maximize income from OhmConnect.

Make The Most Of OhmHours

If you reduce your energy consumption a little bit during OhmHours, you can expect to earn around 45 points per OhmHour. Over the course of the year, that means you’ll earn about $23. Not too exciting. But you can boost your earnings using these “hacks.”

- Level up, and quickly. Every OhmConnect user has a ‘Status Level’, ranging from Carbon to Diamond. Your Status is determined by the average amount you reduce during the last five #OhmHours. The higher your Status, the more points you'll earn (15% below baseline = 6x points, 40% below baseline = 10x points, 80% below baseline = 12x points).

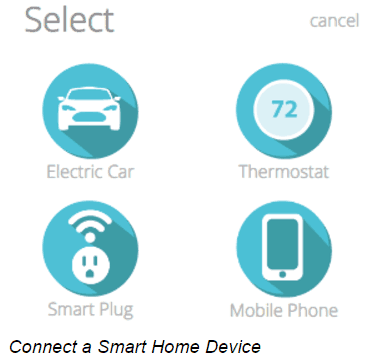

- Connect your smart home devices to OhmConnect and you could earn 3x: OhmConnect automatically reduces consumption for you during OhmHours and AutoOhms (which are shorter events with less advance notice and which only device users can participate in).

- Put your fridge on a smart plug: One of the biggest energy hogs in the house are fridges and freezers. Put these on a smart plug, hook it up to OhmConnect, and you’re virtually guaranteed to reduce electricity during an OhmHour. OhmConnect estimates that by connecting your fridge to a smart plug, you’ll pocket an extra $20 a year, $30 for a freezer and $150 if you connect a smart thermostat.

- Get on a streak: You can earn double points by consistently reducing energy during OhmHours. Once you earn points in an OhmHour, you will get an additional 5% streak bonus for each successful OhmHour afterwards until you reach 100%.

If you take care of these “hacks”, you can expect to earn around $500 per year. Some users reported earning as much as $2,400 in their first year by automating their home and making a game out of saving energy.

Get Crazy With Referrals

As an OhmConnect user, you can get a unique referral code. If your friends signup for OhmConnect, and they reduce their energy use during one OhmHour, you earn a 2,000 point bonus. That’s a $20 signup bonus!

One customer earned more than $11,000 through the referral bonus system, and other users said they earned a few hundred dollars.

Get paid via PayPal

Once you earn at least 1,000 points ($10), you can cash out your points via PayPal. You can also use your points to buy gift cards, donate to charity or use it as a credit for the OhmConnect store. OhmConnect has a variety of smart plugs, home thermostats, etc. to help you reduce your consumption further.

Final Thoughts on OhmConnect

If you're in California, it makes sense to sign up for OhmConnect.

It’s a great tool to help you become more energy (and financially) conscious. You’re not likely to earn a ton from OhmConnect, but you don’t lose anything by signing up.

Participants outside of California won’t see the same benefit as Californians. Outside of California, you can earn referral bonuses to OhmConnect, but you can’t earn points during OhmHours.

OhmConnect educates its users on how to save energy efficiently and thus makes saving money on your utilities year round easier.

Have you ever heard of OhmConnect?

OhmConnect Review

-

Commission & Fees

-

Customer Service

-

Ease Of Use

-

Features & Options

-

Location & Availability

Overall

Summary

OhmConnect is a clean tech company that helps its users to save energy & make money.

Pros

- Easy way to make some extra money while saving energy

- Rewards scale based on how much effort you want to put in

Cons

- Limited availability nationwide

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Clint Proctor