Putting extra change in a jar can accumulate into some real savings surprisingly fast. But then you have to use cash for your purchases, wrap all those save coins, and bring them to the bank to add them to your account.

But, with a large number of banks and apps, there's an easier way. Many now provide a way for customers to round up transactions in their bank account or credit card and apply to them to a savings account. It's a new spin on the change jar for the digital age.

ChangEd takes this concept even further by applying unused change to your student loans. By using the ChangEd app, it rounds up each transaction to the nearest dollar and applies the difference to your student loans once $100 is reached. In this article, we’ll do a review of the ChangEd app.

What Is ChangeEd?

ChangEd is the brainchild of two brothers - Nick Sky and Dan Stelmach. The idea was hatched when Dan became discouraged with the interest and payments on his student loans and thought to himself, “Man, something needs to change. Boom! Change — spare change. What if I rounded up the spare change from my transactions and sent that to my student loans?”

Dan brought the idea to his brother, Nick. Nick said, "I thought it had a lot of potential. A lot of people are struggling. I have student loans. All of my friends have student loans. It's something I felt would be impactful to a huge market.” From those conversations, ChangEd was born.

What Does It Offer?

ChangEd’s mission is to help borrowers effectively repay and automate the process. Borrowers can build a repayment path that helps them save the most. They can choose which loans they want to pay off first and the platform builds recommendations to tackle the next loan that will save them the most. Here's how it works.

Round-Ups

After you have completed setting up your ChangEd account, the app will start analyzing your spending. Then it will begin to round up your transactions and put the difference into a ChangEd account that eventually gets sent as a student loan payment.

As an example, when you spend $2.54 for coffee, the app will save $0.46. Once you get to $5 in savings, it will send the money to your ChangEd FDIC-insured account.

Once your ChangEd account reaches $50, the money will be sent to your student loan account as a payment. You can also multiply roundups or set different savings speeds based on transaction categories.

Note that you can pause round-ups at any time. Currently, the app allows users to set up a pause for 15, 30 or 60 days.

Extra Payments

ChangEd offers more ways to save than just round-ups. They also make it easy to boost your savings with additional payments towards principal. Frequency options include daily, weekly, monthly, and pay periods.

Tracking Your Progress

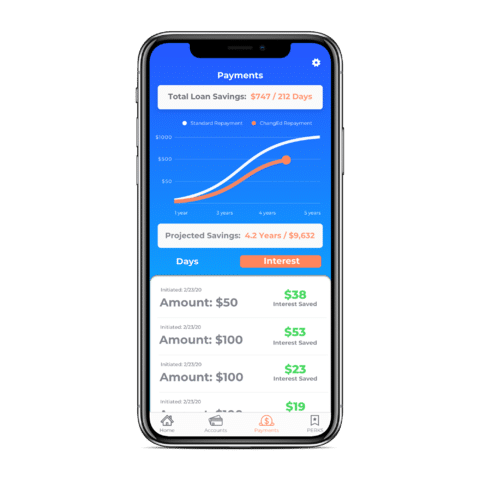

One of the best parts about using ChangEd is the ability to see your progress. The app does a great job of this. As your extra change is applied to your student loans, the app displays the number of years and interest you’ve cut off your loans.

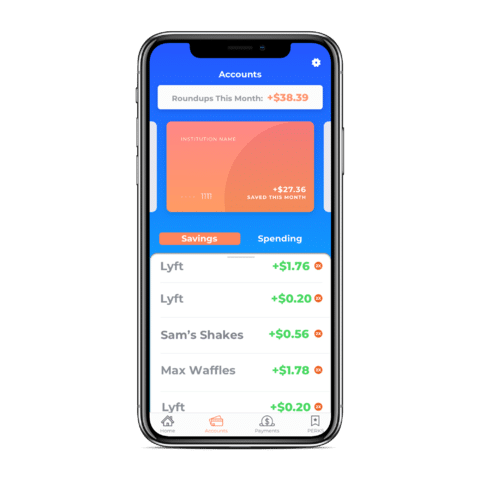

You can also see all of your transactions and the rounded up amounts within the app. Below are several screenshots of the app interface showing transactions on the left and impact to loans on the right.

Family And Friends Accounts

ChangED makes it easy for family members and loved ones to contribute towards your student loans too. All they have to do is create an account with their own email address and then enter your student loan info.

It's as simple as that! Just like with personal accounts, family and loved one accounts come with all the bank linking, round-ups and extra payment features. The only difference is the person who opened the account will be helping pay down your debt instead of their own.

How Does ChangeEd Compare?

ChangEd is a novel take on the saving through spare change. If you have difficulty sending extra payments to your student loans or do it inconsistently, ChangEd can certainly make a difference. The app automates the entire process, so you never have to think about it.

But unlike some of its competitors, ChangeEd doesn't offer any guidance or resources to help borrowers find the best repayment plan or qualify for federal forgiveness programs. Take a closer look at how it compares in this quick chart:

Header | |||

|---|---|---|---|

Rating | |||

Cost | $3/month | Free | Free |

Links Directly To | |||

Round-Ups | |||

IDR Plan/PSLF Document Prep | |||

Cell |

How Do I Open An Account?

The first step in signing up for a ChangEd account is to visit its website. From there, you'll find links to download the app from the Apple App Store or Google Play Store. Then follow these steps in the app to create your account:

- Enter your email and choose a password

- Enter your student loan info

- Enter your personal info

- Link your spending account

- You’re done!

Is It Safe And Secure?

Yes, ChangeEd generally uses Plaid to directly and securely link to your spending accounts (although manual account linking is available). All transactions related to payments or other financial transactions are encrypted using SSL technology.

Also, the ChangeEd accounts that hold your round-ups until you reach the $50 threshold are FDIC-insured through Evolve Bank & Trust.

How Do I Contact ChangeEd?

You won't find a customer service phone number on ChangeEd's website. If you have a question or problem, you'll need to reach out via email at support@changedapps.com.

However, once you download the app, you'll have easier access to assistance. You can simply navigate to the "Contact Support" settings menu to quickly start a conversation.

Is It Worth It?

ChangEd can certainly help with shaving off time and interest on student loans. How much time and interest depends on how many transactions someone has within each month. For those of us who have a difficult time making extra payments on our student loans, the automatic payments of ChangEd is a welcome feature.

But if you're looking for an app that can also help you optimize your repayment plan or see if you qualify for loan forgiveness, you may want to look for another debt payoff app. And if you're looking to reduce your interest rate on your student loans, you can check out our favorite student loan refinancing companies here.

ChangEd Features

Price | Student loan sync, round-ups, automatic payments |

Cost | $3/month |

Loan Sync | Yes |

Bank Sync | Yes |

Automated Payments | Yes |

IDR Plan Filing Assistance | No |

PSLF Filing Assistance | No |

Payment Tracking | Yes |

Credit Score Monitoring | No |

Transfer Threshold | $5 |

Payment Threshold | $50 |

Transfer Pause | Yes, 15, 30 or 60 days |

Live Consultations | No |

FDIC Certificate | 1299 (through Evolve Bank & Trust) |

Customer Service Options | Email only |

Customer Support Email Address | support@changedapps.com |

Web/Desktop Access | No |

Mobile Apps | Yes, iOS and Android |

Promotions | None |

ChangEd

-

Ease of Use

-

Pricing & Fees

-

Features and Automation

-

Customer Service

Overall

Summary

ChangEd is a mobile app can that help you round up spare change to pay down your student loans faster.

Pros

- Connects to all student loan servicers

- Round-ups make saving effortless

- Offers “Family & Loved Ones” accounts

- Easy to pause or customize round-ups

Cons

- Not a free app

- Doesn’t advise on repayment plans

- No PSFL application support

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Clint Proctor Reviewed by: Chris Muller