Monarch Money is a personal finance app dedicated to helping users achieve their financial goals that has excellent tracking and bank connectivity.

The money management app features unlimited customization for spending categories, excellent “under the hood” technology, and compelling visuals.

When we first reviewed Monarch Money, there were a few key features that we felt were missing. But we've been pleased to see that the Monarch Money has been busy with consistently adding requested features over the past several years. Here's what we think about the platform today.

Monarch Details | |

|---|---|

Product Name | Monarch Money App |

Price | $14.99/month or $99.99/year |

Platform | iOS, Android, Web |

Features | Financial Planning And Budgeting |

Promotions | 7-Day Free Trial |

What Is Monarch?

Monarch is a Silicon Valley startup that has built a new money management platform. Its co-founders and software engineers have been developing the technology behind the scenes since 2018. But the product didn't publicly launch until the end of 2020.

In the world of personal finance advice, a lot of attention goes towards long-term planning and investing for retirement or long-term wealth-building. But a huge portion of real-life financial planning involves setting and reaching goals that are a few months or a few years away. Whether you’re saving for a Supreme sweatshirt or your first house, you’ll need a plan to save enough money to reach the goal.

Monarch is different in that focuses heavily on short and mid-term goals planning. To be clear, it does have net worth, budgeting, and investment components. But these are secondary to its goal-planning tools and features for near-term savings.

Plus, in 2024, we named Monarch Money one of the best budgeting apps!

What Does It Offer?

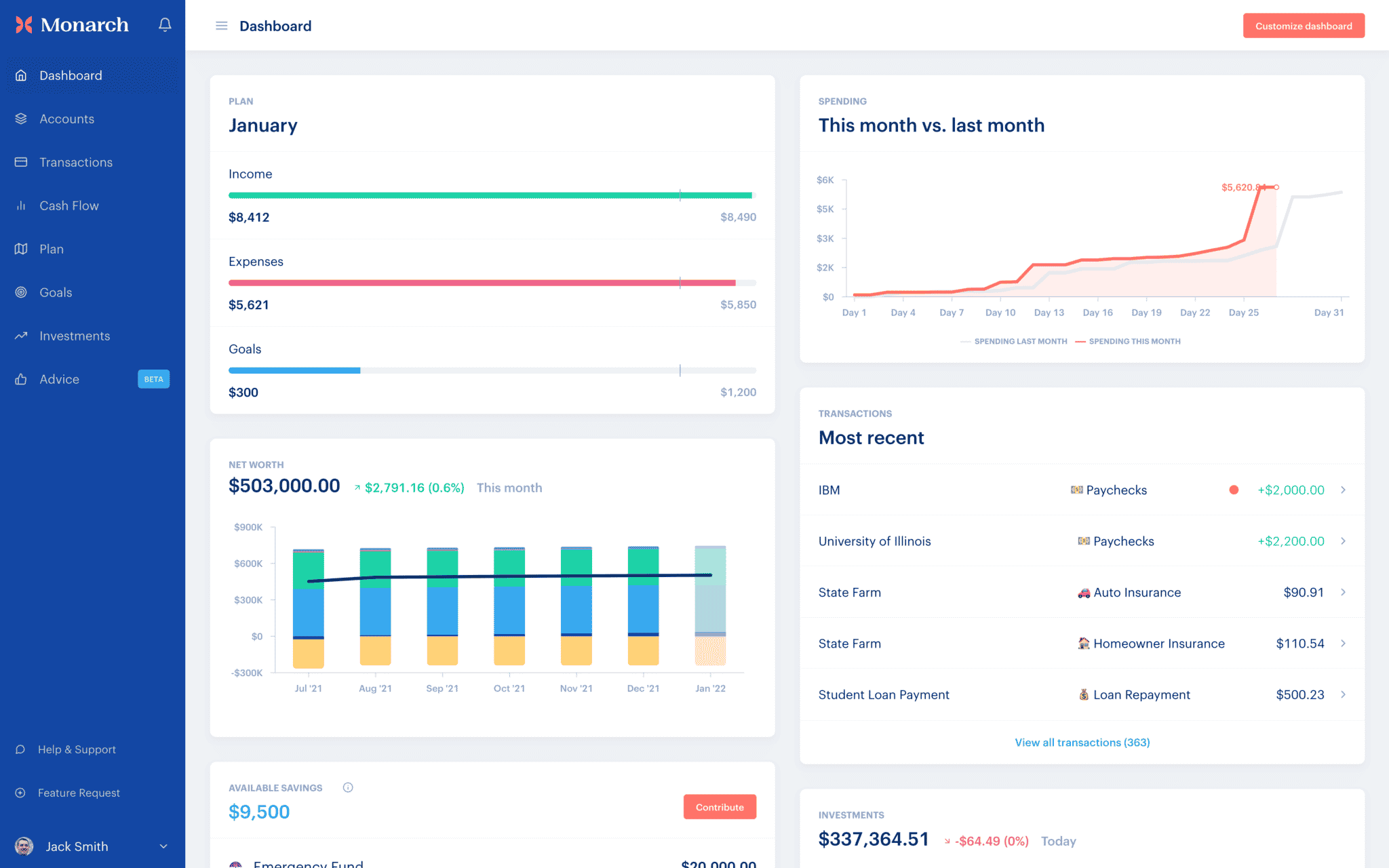

Users connect financial accounts (called Synced Accounts) to the app. The app then works to automatically categorize transactions into specific categories. Users can update the categorization, and customize categories.

If you’ve got assets outside of Synced Accounts, you can enter those manually into the app. That makes it easier to track your real net worth in the app. Once you’ve connected your accounts, Monarch will suggest a budget and calculate your net worth. You can also enter as many goals as you want financial goals section.

Once a goal is created, users can designate how much free cash goes towards a financial goal. This doesn’t physically move money around. Instead, it categorizes money that’s in a savings or checking account as money for a specific goal.

You can also customize the categories, which is very helpful.

Sync All Your Financial Accounts

There are currently over 11,200 bank, brokerage, and other financial accounts that can be synced with Monarch Money. Unlike some of its competitors, Monarch uses more than one data aggregator to increase its sync coverage. For example, you can link your real estate values via Zillow Zestimate to get a picture of your real estate net worth.

The drawback is there is limited support for crypto. Right now, only Coinbase is supported, but there are plans to allow you to connect other exchanges and wallets in the future.

Monitor Your Transactions And Cashflow

If you're looking for a solid spending tracker to see how you're spending your money and where you cash is going, Monarch offers a great solution. You can track your transactions, categorize them, create custom categories, and even setup tags for other members of your household.

This is a solid tool to allow you to track your spending and create a budget.

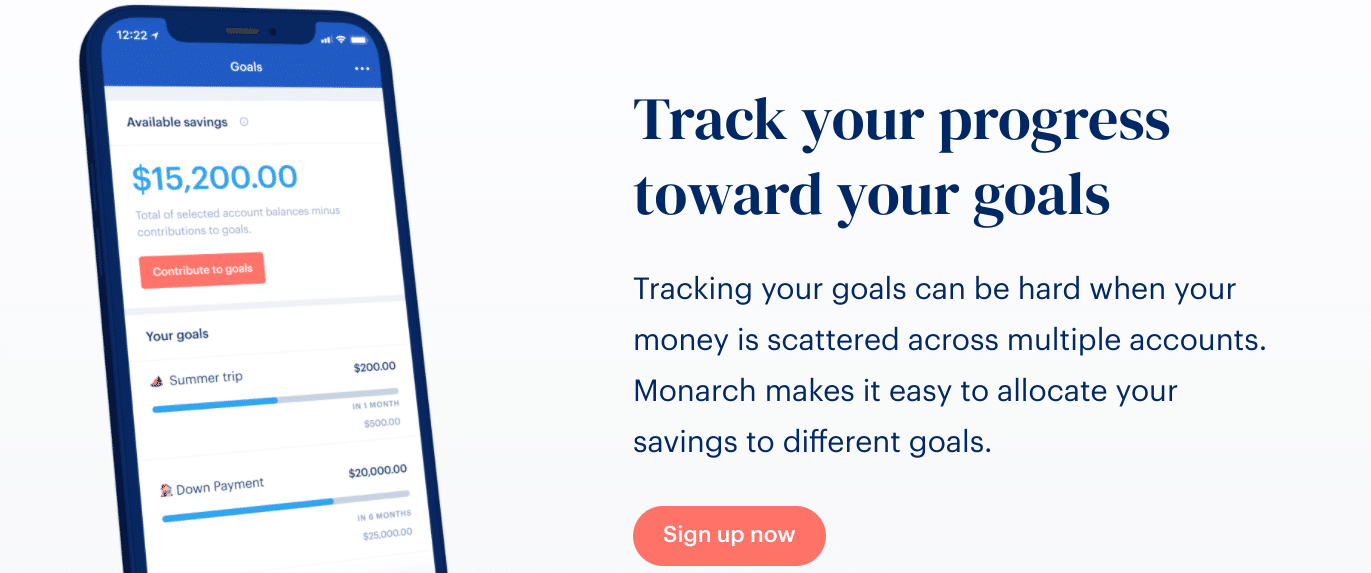

Create And Track Your Goals

Monarch's focus on goals-based planning is its primary point of differentiation. Users who need help breaking up large goals into smaller pieces will be pleased.

The app also allows users to “direct free cash" to specific financial goals. When you put money towards a goal, the app rewards you. The little confetti reward on the screen is surprisingly fun. It makes financial progress into a small celebration.

From a technical perspective, the app also seems to have very good transaction categorization technology. The algorithms for categorizing transactions were spot on. This is the best implementation of transaction categorization that I’ve seen.

The net worth tracker also had a nice visual element to it. More online money management tools should show net worth over time. The Monarch money app does it right.

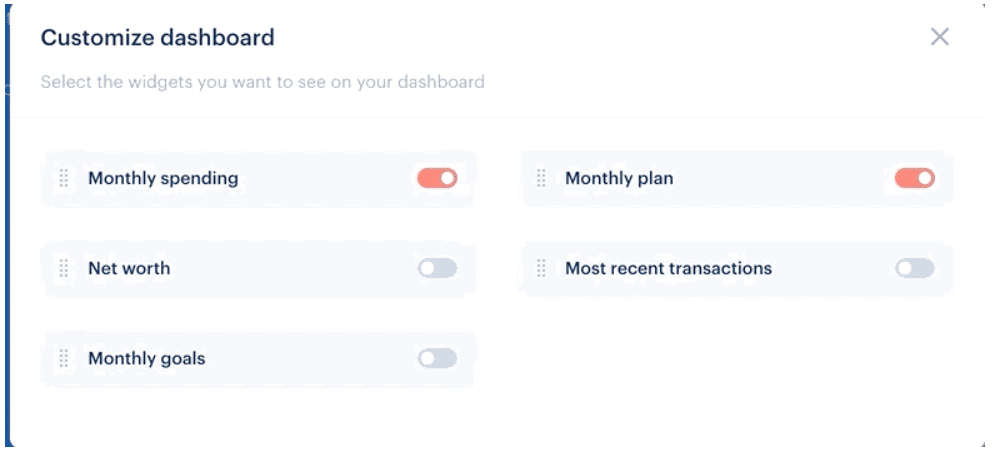

Customizable Dashboards

After logging into your account, you'll notice a "Customize dashboard" option at the top of your Dashboard page. After tapping that button, you can drag and drop the widgets to change their order or remove elements completely.

Note that you can customize your web and mobile dashboards independently of each other. This gives users even more flexibility to build the optimal viewing experience for every situation.

Investment Tracking

In our initial review of Monarch Money, the lack of investment tracking tools was one of its major downfalls. However, Monarch listened to its users and recently launched its new investment feature.

Compared to Quicken, their investment features are very lacking still. However, this is one of the top features on their roadmap, so we are hopeful this continues to be built out.

Now, you can use the app analyze your entire portfolio across multiple brokers and accounts.

The investment tracking is still not as robust as some of the competitors. You can see your holdings and a benchmark to the index (very similar to Personal Capital), and you can see the "type" of investment. However, there is no investment allocation tracking yet, and it's difficult to track income from the investments (for example, there's no native "Dividend" category).

Also, the only cryptocurrency support available right now is Coinbase.

How Much Does It Cost?

Monarch offers a 7-day free trial. Following the trial, subscriptions cost $99.99 per year or $14.99 per month.

How Does Monarch Compare?

Monarch's monthly subscription fee is slightly lower than YNAB while it's annual subscription fee is a few dollars higher. Empower (formerly Personal Capital) is a free option compared to both Monarch and YNAB, but your data is used for upsells and over the few years, the product has deteriorated in terms of connectivity and new features are rare.

Here's a quick comparison of the three tools:

Header |  | ||

|---|---|---|---|

Rating | |||

Pricing | $14.99/month or $99.99/year | $14.99/mo or $98.99/yr | Free |

Free Trial | 7 Days | 34 Days | N/A |

Platform | iOS, Android, Web | iOS, Android, Web, Alexa, and more | iOS, Android, Web |

Cell |

How Do I Contact Monarch?

You won't find a customer service phone number listed anywhere on Monarch's website. However, the company does offer live chat customer support that you can access once you've logged into your account. You can also email Monarch at support@monarchmoney.com.

Is It Safe And Secure?

Any platform that literally wants to access all of your financial accounts needs to place a strong emphasis on security and privacy. Thankfully, Monarch uses Plaid as its primary data aggregator which is the trusted industry leader and maintains strict security standards. Plus, it also has other connections as well.

Additionally, Monarch says that it never sells any of its users' private information to third parties. It also offers multi-factor authentication for account logins.

How Do I Open An Account?

You can get started with Monarch by visiting its website or downloading one of its mobile apps. After providing your account information and beginning your 7-day free trial, you can begin linking your financial accounts.

In most cases, you'll simply provide your login credentials. But Apple Card has a unique setup process as do Capital One, Wells Fargo, and Charles Schwab accounts. Note that you can create "Manual Accounts" and add manual transactions for anything that isn't connected to a bank or can't be synced for some other reason.

Why Should You Trust Us?

I have deep experience with using "Personal Financial Managers" or PFMs like Monarch Money. I started using Quicken in the early 2000s to track my personal finances, and since then, I've used or tested almost every budgeting app and investment tracking app in the marketplace.

I've spend over 20 hours using Monarch for both testing and tracking my own finances - using both the web version and app version on my iPhone.

Combine my personal experience with that of our amazing team of editors and testers, and we have over 100 years of combined experience using, reviewing, and testing budgeting apps and tools!

Who Is This For And Is It Worth It?

Monarch has a unique point of view among financial apps. I love that it helps users celebrate progress towards financial goals. It's also great to see that the Monarch team has been updating their technology at a feverish pace.

The budgeting and spending tracking is great, and the investment tracking is improving. When they launch full cryptocurrency support, it will be a solid comeptitor to many of the newer finance apps out there.

With a 7-day free trial available, there's really no risk in giving Monarch Money a try to see if it meets your needs. But if you don't feel like it's the right financial app for you, know that you have plenty of other strong options.

Monarch Money FAQs

Here are a few of the most common questions we hear about Monarch:

Can I use Monarch if I don't live in the United States?

Currently, Monarch is focused on serving U.S. customers and connecting with U.S. financial accounts.

Does Monarch allow shared accounts?

Yes, you can invite family members and other members of your household to share your Monarch Money account. Each user will have their own login and password but will be able to view the same accounts, transactions, and goals.

Can I add receipts to my transactions in Monarch?

Yes, the platform allows users to attach receipts and/or notes. Up to three images can be added per transaction.

How can I suggest a new feature to Monarch's team?

You can send suggestions and vote on others suggestions by tapping the "Feature Request" button in the bottom-left side of your screen when using Monarch Money on the web.

Monarch Features

Price |

|

Budgeting | Yes |

Income Tracking | Yes |

Expense Tracking | Yes |

Bank Integration | Yes |

Investment Tracking | Yes |

Credit Score Monitoring | No |

Net Worth Tracking | Yes |

Bill Pay | No |

Tax Preparation | No |

Import Bank Data Files | Yes |

Customer Support Options | |

Customer Service Email | support@monarchmoney.com |

Web Account Access | Yes |

Mobile App Availability | iOS and Android |

Promotions | 7-day free trial |

Monarch Review

-

Pricing and Fees

-

Ease of Use

-

Customer Service

-

Tools and Services

-

Mobile App Functions

-

Connectivity

Overall

Summary

Monarch is a money management website and app that can help you budget, create a financial plan, and track your goals. Learn how it works!

Pros

- Budget and investment tracking

- Syncs with over 11,000 financial institutions using multiple aggregation services

- Allows spouses or other household members to share dashboard with their own unique logins

Cons

- Pricing is on the high side

- Limited cryptocurrency tracking

- Limited investment tracking

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Clint Proctor Reviewed by: Ashley Barnett