Qapital is an all-in-one banking and investing app that really is trying to help you put more money away for the future.

Saving money has always been a difficulty for you and you would like a solution that finally knocks that beast to the ground?

The good news is that, in recent times, Americans have gotten better at saving money.

A Bankrate survey showed that only 24% of adults say they have no money saved up for an emergency.

Forty-eight percent (48%) of people surveyed however do have savings accounts that could cover 3-6 months of expenses if an emergency came up.

These are impressive numbers and the great thing is that you can take steps to join this 48%.

An effective way to save money is to automate it in a “set it and forget it” way so you save money without even realizing that you are doing it.

If you own a cell phone and a checking account, the Qapital app might be that solution to help you get there.

Configured properly, the Qapital app can be a true “out of sight, out of mind” way to put money away towards your emergency fund, save up for a trip or even set up long-term goals for the future - including investing.

Qapital Details | |

|---|---|

Product Name | Qapital |

Min Deposit | $0 |

Monthly Fee | $3 - $12/mo |

Account Type | Banking And Investing |

Promotions | 30 Day Free Trial |

How Qapital Works

Qapital is available to users on Android and iOS devices. It is also now FDIC insured for up to $250,000.

When you first download Qapital and create a bank account, you will have the opportunity to link a checking account you already have. Your checking account becomes your “funding account”.

Next, you will have to set “Goals” within the app that follow particular “Rules”. So you can decide that you have a goal saving $1,000 towards an emergency fund. You can then set the rule that $20 be moved from your funding account to a secure Qapital account every time you shop at the grocery store. You can even set up interesting rules that have you saving money every time you watch an NBA game on your phone for instance.

A more recent addition to Qapital is the ability to create a spending account which links to a Qapital Visa Debit card. The benefits with creating a Qapital spending account include:

You can combine the rules with Qaptial saving and earn a little bit of interest on your money. You might want to compare this with a traditional high yield savings account.

Qaptial Investing App

Qapital has spent a lot of time significantly improving their investing app. If you're on the Complete plan or higher, you'll have access to investing features.

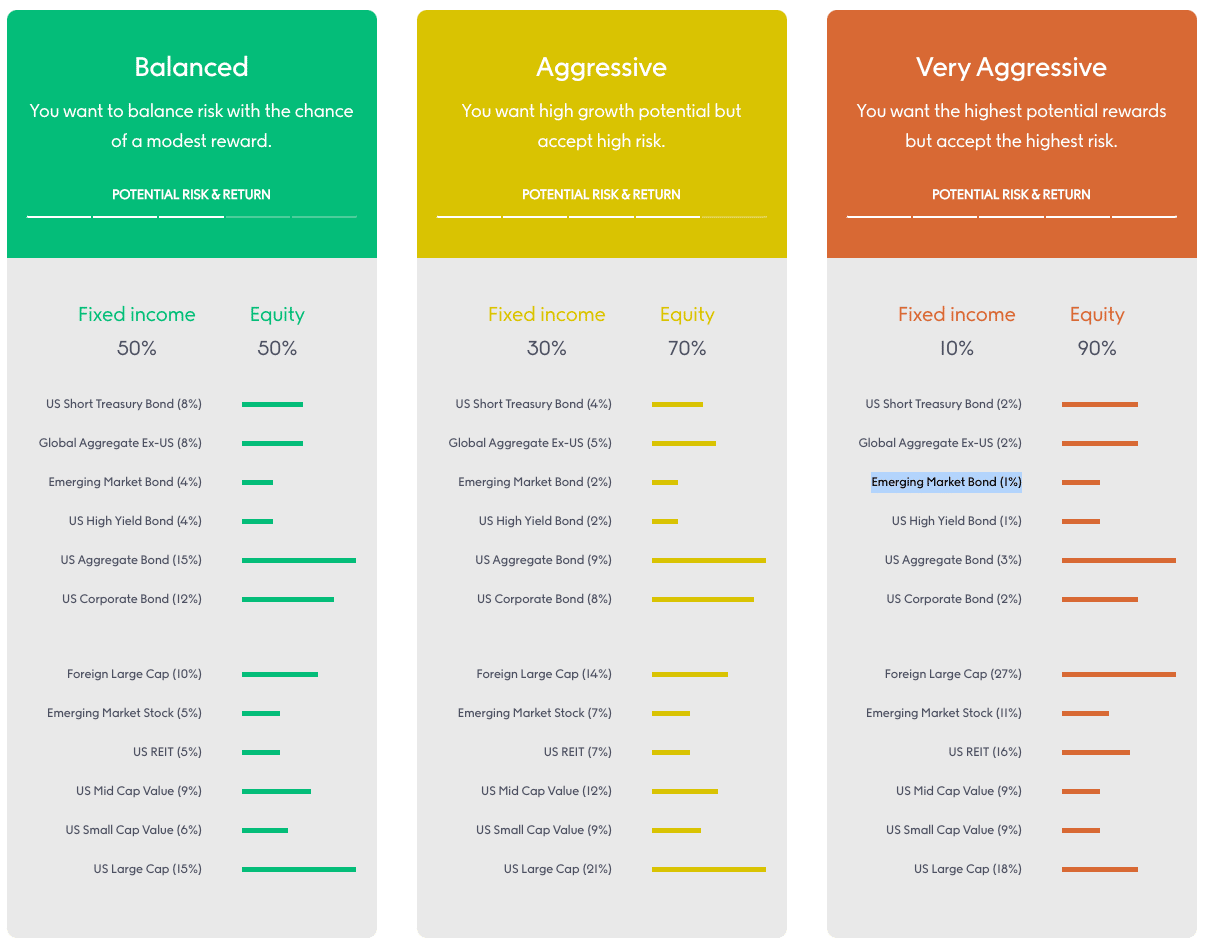

Qaptial acts like a robo-advisor, where you answer a few questions about yourself and your timeline, and Qapital will put you into a portfolio that matches what it thinks are your requirements.

There are 5 portfolios: Very Conservative, Conservative, Balanced, Aggressive, Very Aggressive.We would argue even the "very aggressive" isn't that aggressive given its 10% in bonds.

Qapital Pricing and Plans

Qapital has a membership based structure. You get a 30 day free trial, before you have to start paying. You can try Qapital here for 30 days free.

The plans are:

Basic ($3/mo) - The basic plan gives you access to Qaptial's saving, spending, and budgeting tools. It also allows the goal based approach they are known for.

Complete ($6/mo) - The complete plan is an all-in-one financial solution. The goal is to seamlessly integrate Qapital's tools into a complete picture for you. This level includes the invest tools.

Premier ($12/mo) - The master plan is for people that want a greater understanding of their money. You get all the options of the lower plans, but also exclusive webinars and in-app challenges.

As of now, we only see value in the Basic plan.

New Products To Help You Gain A Bird's Eye View Of Your Money

Qapital plans on launching three new products to be rolled out throughout 2023. Expect to see a new and improved suite of easy money tools that will provide you with a more holistic view of your entire financial life. For example, you'll be able to do the following:

- Manage loan payments in the same place you plan for retirement

- Boost savings goals with cash back rewards earned while you shop online

Here's what they plan on rolling out:

Qapital Dream Team™: Collaborate on your finances with a partner, share goals, and reach them faster together. Make account balances and transaction histories visible to each other, and leave comments directly in the app. You decide what’s shared with your partner and what stays private, always.

Debt Wrangler™: New tool that handles everything related to borrowing. It makes it easy to see what you owe, choose a payback strategy, and automate your loan payments. Reduce your monthly payments with in-app refinancing, or get debt-free faster and pay less interest over time. The feature will be initially available for student loan management, then expand to cover other types of debt. The upcoming product release will give users time to get a plan in place before the Federal student loan payment moratorium ends on January 1, 2023.

Qapital Cashback Hacks™: Automatically finds rebates and coupons for over 12,000 online retailers. Your rewards go directly into your Qapital goal account, so you can save while you shop. The browser extension is simple to set up and it’s available for both Chrome and mobile Safari.

How To Access The Money You Save With Qapital

When you save money with the Qapital app, the money is held at Wells Fargo.

It used to be that the only way to access the money was through the Qapital app by transferring it to your regular checking account or you could get cash back when you use it in a store. However, Qapital now has a Visa Debit card that you can use to access and spend your money.

Withdrawal of your money can be made at any time and is free of charge.

Security

For an app that is easily accessible on your phone and which links to your bank account, it would be surprising if security was not a concern.

The recent Equifax breach makes this an even more pressing need.

Qapital maintains that they do not sell your information to third-party companies and that your personal data is encrypted between the Qapital app and their servers.

The information from their servers to any third party partners is also encrypted so that sensitive information is not relayed from their end.

An extra word here: Although Qapital does provide these assurances for protecting your personal data, it is alright if you are wary of the security features and want to include an additional layer of protection using some form of identity theft protection service.

By and large, the Qapital app is a great, easy way to put money away towards any financial goal you have without having to actively think about it.

The Biggest Drawbacks Of Qapital

Although there have been independent raves about Qapital (like this one) and the Qapital app has a 4.8 rating in the Apple Store and 4.4 rating in the Android store, it would be irresponsible not to raise some of the misgivings some users have had about the app.

Amongst those complaints have been :

- Difficulty linking checking accounts to the app

- Some users report not being to pause rules at all which can be a problem if you happen to be running low on funds from your regular checking account

- The app being overall “buggy” since the Spending Account was introduced

- The app taking too long to withdraw money from external bank accounts to put towards the savings goals (Might be why they created their own spending account?)

Most users however, (as per user reviews in the Apple Store and Android store) are very happy with the Qapital app and the “set it and forget it” nature of the app when it comes to saving money is a common reason they cite.

Final Thoughts On Qapital App

Qapital has become a less attractive savings app because of its pricing structure. If you need help saving, then the $3/mo tier might be helpful for you, but we don't see value in the higher tiers at this time.

Hopefully, Qapital proves us wrong and continues to provide great value in automatic savings.

Check out Qapital here.

Have you tried Qapital? What are your thoughts on it?

Qapital Review

-

Savings Options

-

Ease of Use

-

Customer Service

-

Comission and Fees

Overall

Summary

Qapital is a mobile banking app that helps you save spare change automatically.

Pros

- Budgeting app that is goal-focused

- Has banking products built-in

- Couple sharing is unique in budgeting apps

Cons

- Pricing is above-average

- Investing can only use their preset portfolios

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Clint Proctor Reviewed by: Ashley Barnett