Some small-cap stocks have the potential to take off and become the next big thing.

Investing in small caps, though, can be a wild ride, as they tend to be more volatile than larger companies.

So what are small caps and how do you invest in them anyway? Let’s find out.

If you're looking for a place to invest in small-cap stocks, check out our list of the best online stock brokers.

Small-Cap Stocks Defined

The “cap” in “small cap” refers to market capitalization, which represents the size of the company. Market capitalizations can be calculated by multiplying the shares outstanding by the current stock price. For example, a company with 100 million shares outstanding and a stock price of $5 has a capitalization of $500 million.

Companies with market caps between $300 million and $2 billion are considered small caps, although this range is not set in stone, as different people may use different ranges. Companies below $300 million are considered micro caps.

Is a small cap the same as a penny stock? Not necessarily. Penny stocks generally trade for less than $5 per share and are often found on the over-the-counter (OTC) market. They’re also very high-risk. However, a small cap can be a penny stock.

For example, company ABC has 100 million shares outstanding and a stock price of $4.50. While the stock price makes ABC a penny stock, at $450 million, the market cap makes ABC a small cap. ABC is both a penny stock and a small cap.

Examples of Small-Cap Stocks

The following are three examples of small-cap stocks along with their market cap:

- Southwestern Energy Company (SWN) — $839 million

- California Resources Corporation (CRC) — $345 million

- Kaman Corporation (KAMN) — $1.7 billion

The stock price of SWN is $1.53, making it a penny stock as well.

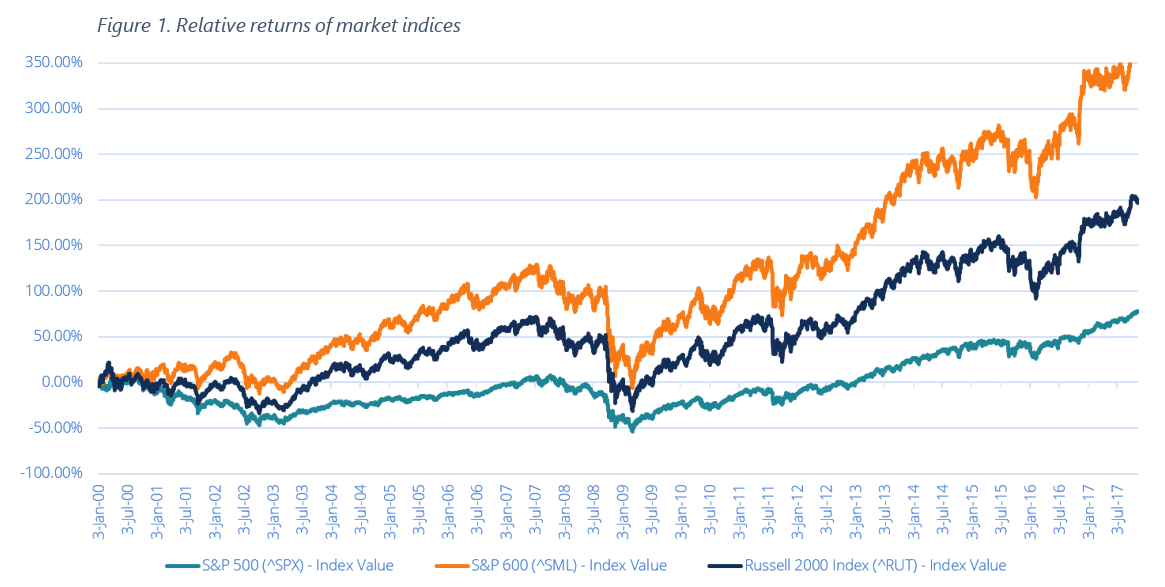

Performance of Small-Cap Stocks

Small-cap companies are more nimble compared to mid- and large-cap companies. During a recovery, small caps tend to perform best, as they lead the pack. This is mainly because of their ability to move quickly.

While larger companies issue bonds to raise capital, small caps sell shares of stock to fuel their growth. In the process, small caps must give up equity. In contrast, larger companies are able to issue bonds (i.e., debt) because of their maturity and good credit ratings.

The chart below shows the performance of two small-cap indices compared to the S&P 500.

Source: https://corporatefinanceinstitute.com/resources/knowledge/trading-investing/small-cap-stock/

Small-cap stocks can be volatile. Many larger institutions such as endowments, pensions, and hedge funds don’t invest in them as much as mid- and large-cap stocks. This means the players in small caps are also smaller, leading to less stock price stability in the group. Small caps can experience run-ups in their stock prices, only to collapse quickly.

There’s also the issue of analysts’ coverage. Large-cap names such as Microsoft, Apple, and Amazon are covered broadly by analysts. But there isn’t as much coverage on SWN, CRC, and KAMN, which means you’ll need to do additional research.

This can be time-consuming, but good research can pay off. Figuring out which companies have good management, strong financials, and the potential for growth is worth knowing vs. just grabbing a handful of small caps and hoping for the best.

Investing in Small-Cap Stocks

There are a few ways to invest in small caps. These include buying shares in funds, ETFs, and stocks.

Some funds and ETFs mimic small-cap indices such as the S&P 600 or Russell 2000. Buying these index proxies means 100% exposure to small caps. That might not be bad if your portfolio has other diversified holdings. The iShares Core S&P Small-Cap ETF (IJR) follows the S&P 600 index. The iShares Russell 2000 Index (IWM) follows the Russell 2000 index.

Some small-cap funds target specific sectors. The Invesco S&P SmallCap Energy ETF (PSCE) is one example. It is a market-cap-weighted index of small-cap energy stocks. Other ETFs may follow emerging markets or junior gold miners small caps.

There are also funds and ETFs that have limited exposure to small caps. These funds may contain a small percentage of small caps and a diversification of other sectors and market caps. This mix allows for some exposure to small caps while also trying to keep volatility within the fund low.

Finally, you can buy shares of individual small companies. This might be riskier compared to the above choices since you have exposure to a single company rather than several. It also means you’ll need to do the research to vet each company for quality.

Investing in small-cap stocks can be rewarding. It’s a chance to discover the next Microsoft, Apple, or Google. Learning about fundamental and technical analysis can help you reveal if a particular small cap has great growth potential or not.

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Clint Proctor Reviewed by: Colin Graves