90% of the world's millionaires have created wealth through real estate. At least that's what Andrew Carnegie said at the turn of the century.

Maybe you love investing, and at this point nearly all of your money is in the stock market. You know it’s important to diversify, but aren’t sure if real estate investing is right for you. You might think it requires a lot of money up front, or requires a lot of work ongoing.

And while some of that is true, there are new options this year that can make real estate a potential investment for you.

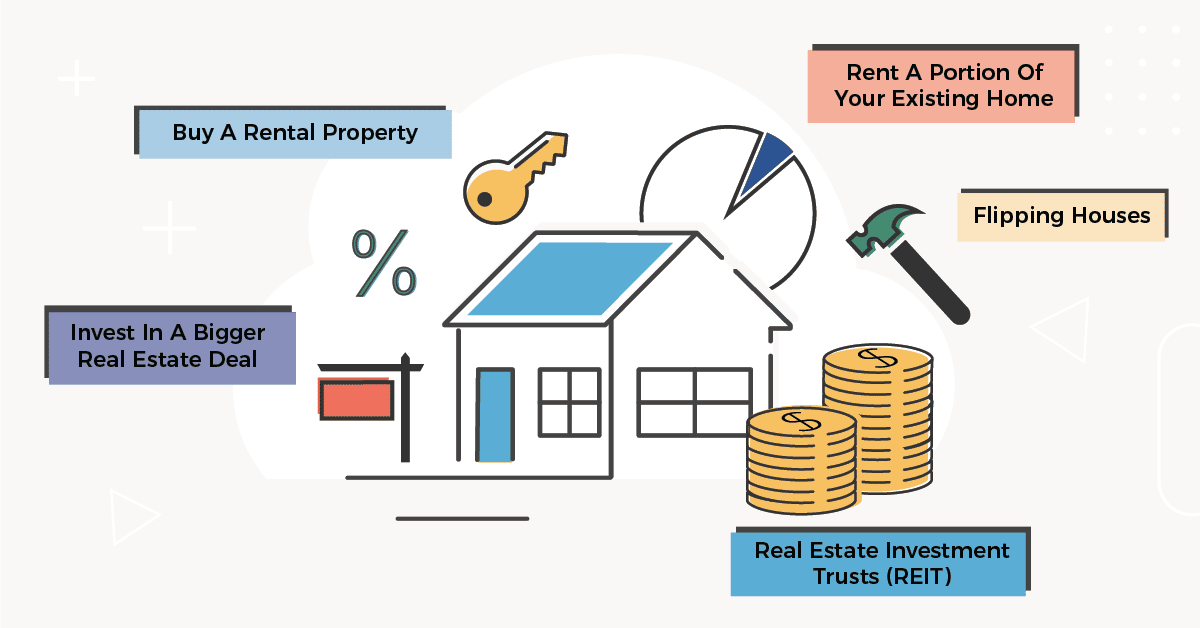

While real estate investing certainly isn’t for everyone, it can be very lucrative. Many people have made millions investing in real estate. If you’re wanting to expand your investment horizons, here are 5 different ways to invest in real estate.

1. Invest In A Bigger Real Estate Deal

One of our favorite options for investing in real estate is joining with others to invest in a bigger deal. This can be either commercial or residential.

There are two great things about investing in a larger real estate deal online:

- Low minimums - depending on the platform you use, you can invest as little as $500 and be an owner in a property.

- You don't have to be an accredited investor - in the past, to participate in these types of investments, you had to be an accredited investor, but that rule has gone away for certain investment types

As such, if you're looking to diversify your investments, but don't have a lot of money to do it with, this could be a lucrative way to start.

We recommend three platforms for investing in real estate:

- Fundrise - Fundrise is a real estate investment trust (REIT) that allows you to invest in a basket of real properties. As such, you get a little diversification on your real estate investment. Plus, you can get started for just $500. Check out Fundrise here¹.

- RealtyMogul – RealtyMogul offers investors a variety of properties to choose from, including residential, mixed-use, commercial and retail. They don’t charge their investors fees, instead placing that burden on the property holders. Investors can start seeing a return just a few weeks after the project is funded. We are partners with RealtyMogul and think it's one of the best platforms out there right now.

- Streitwise - A newer private equity REIT that focuses on cash-flowing real estate investments. One of the better fee structures available. Open to both accredited and non-accredited investors. Check out Streitwise here >>

If you're curious about more options, we compared all of the major real estate investing sites here.

2. Buy A Rental Property

Purchasing homes and renting them out is a great way to produce extra monthly cash flow.

To do this, you have to purchase a house that has a combined monthly mortgage payment, home insurance payment, and property tax payment lower than the rent the property commands. There are several ways to do this - from buying in an area with high rents, to putting a lot of money down so that your mortgage payment is low.

One of our favorite ways to do this online is with Roofstock. You can buy single family rental properties (that already have tenants and cash flow) easily online.

There are two downsides to owing a rental property directly. First, it typically requires a lot of cash up front - from the downpayment to the maintenance required. You really need to assess whether your return on investment will be worth it.

The second major downside of real estate is dealing with tenants. You’ll need to screen renters before letting them move in. You’re also bound to hear sob stories at one point or another so you’ll have to learn to be firm with renters. If you’re the type to easily give in to people, you may be better off letting a property management service oversee your rental properties. Either way, there is ongoing work required.

Depending on who you talk to, rental properties can be very lucrative. And, if you do the upfront work of finding those hidden gems, you can let a property management service do the rest and rental properties can be a form of semi passive income.

3. Flipping Houses

Flipping homes can be a bit risky, but also extremely rewarding. And, since property values are back on the rise, this is a good time to get started flipping homes. Flipping a house is the sum of purchasing homes under market value, fixing them up, and then selling for a profit.

To be a successful flipper, you need to hunt down those bargain homes – the less work you have to do the better. The ideal flip home would be one that only needs minor cosmetic repairs. You could then make the home look more aesthetically appealing and sell for profit.

When you decide to flip homes, you have to prepare yourself for the possibility that the home may not sell fast – or for much of a profit. You take a big chance when flipping homes, which is why you have to pay special attention to the homes location, needs, and price. However, if you have the knack for flipping houses, you could find this to be one of the best investments you’ve ever made.

Check out this amazing guide to flipping houses with little money down.

4. Rent A Portion Of Your Existing Home

If you aren’t sold on the thought of purchasing a home only to recoup your money little by little, you could first test the waters by renting a portion of your house (also known as house hacking). You have a couple of options to do this.

First you could rent a spare room in your home or you could rent the basement. If you’re yet to purchase your first home and like this idea you could even buy a duplex and live in one apartment and rent the next.

The advantages to renting a portion of your house is that you get to watch your tenant closely. It’s less likely that a tenant will try to stiff you for the rent payment when you’re in the same household. Renting a portion of your house also gives you the ability to get a feel for what it’s like to be a landlord without making such a huge monetary investment.

Our friend Michelle recently wrote about renting a room to a stranger, which is a great read if you're considering this option.

5. Real Estate Investment Trusts (REIT)

If you think real estate is a great investment but don’t want to get quite so hands on, you could take your real estate investing to the stock market.

Real Estate Investment Trusts (REIT) are great ways for you to invest in real estate without being actively involved. An REIT is a fund that is setup to invest in mortgage instruments, bonds, and stocks in the real estate niche.

There are a few different types of REITS; equity, mortgages, and hybrid. An equity REIT invests in properties, a mortgage REIT invests in mortgages, and a hybrid is the mixture of the two. All three typically offer high yields - basically you get paid back from the interest others are paying on their mortgages.

If you’re strapped for time, investing in REITs is probably the way to go.

Some of the more popular REITs include American Capital Agency (NASDAQ: AGNC), Annaly (NYSE: NLY), Realty Income (NYSE: O).

You can invest in a REIT at your favorite broker. We recommend both Fidelity and Charles Schwab.

What Do You Think?

These days you can invest in just about anything and you should do what feels right for you. Personally, I love real estate, but I know not everyone else does.

If you have been thinking about trying your hand at real estate investing, it’s good to know that there’s more than one way to go about it. Nevertheless, it’s important to do your due diligence before beginning with any new investment.

Which of the ways to invest in real estate have you tried?

DISCLAIMER

¹ The information contained herein neither constitutes an offer for nor a solicitation of interest in any securities offering; however, if an indication of interest is provided, it may be withdrawn or revoked, without obligation or commitment of any kind prior to being accepted following the qualification or effectiveness of the applicable offering document, and any offer, solicitation or sale of any securities will be made only by means of an offering circular, private placement memorandum, or prospectus. No money or other consideration is hereby being solicited, and will not be accepted without such potential investor having been provided the applicable offering document. Joining the Fundrise Platform neither constitutes an indication of interest in any offering nor involves any obligation or commitment of any kind.

The publicly filed offering circulars of the issuers sponsored by Rise Companies Corp., not all of which may be currently qualified by the Securities and Exchange Commission, may be found at www.fundrise.com/oc.

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Claire Tak Reviewed by: Chris Muller